Convex - DeFi "Lego" enables Caterpillar to accelerate revenue for LP and CRV holders

Convex Finance is a DeFi protocol designed to provide the best cash flow to Curve financial service providers and CRV token holders.

Convex Finance received a lot of attention during its inception and TVL's rise. It's because he does something like Yearn. Convex provides CRV holders that can convert CRV holders to a token form of veCRV, also known as cvxCRV.

This solves the problem of veCRV, illiquidity.

Like yveCRV on the Yearn platform, cvxCRV can be converted to CRV via SushiSwap, improving investment efficiency.

From the brief description above, you can see that Convex is separate and Curve and Yearn are separate.

1.Presentation Policy

The great thing about DeFi 2.0 is that you can create different configurations like Lego blocks and call yourself responsibly. Convex is just that.

Curve is one of the largest DeFi decentralized exchanges (DEXs). Curve.fi provides instant benefits to users who quit CRV, but the locking process is irreversible, CRV converts to veCRV, and veCRV is not commercial.

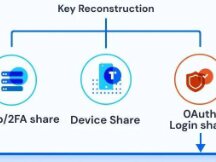

Convex, on the other hand, wanted to get revenue from the curve quickly and wanted to convert some of the water from veCRV to a closed CRV, so they announced the token for a measure against veCRV – cvxCRV.

cvxCRV is a 1:1 conversion of CRV by users, and users promise cvxCRV tokens to receive Curve exchange rates, CRV reward acceleration, and CVX rewards from the native Convex token, as shown in the figure below below.

In the figure, the second row of the vAPR column represents the speed of CRV, the whole process is simpler than the curve operation, and the conversion to veCRV does not lose any smoothness.

So what do users fall for in the process?

Unlike Curve's veCRV, Convex's cvxCRV only has the power to increase your income (which is enough for most people) and lose your right to vote.

Curve's veCRV not only allows users to earn more money, but also allows regulatory authorities such as the vote to determine the CRV distribution of different Curve liquidity pools. The CRV salary for some pool curves is: higher than other pools.

2.Key points

1. Convex allows Curve.fi business providers to get fast exchange rates and CRV returns without closing their CRVs themselves.

Suppliers can get CRV recovery and extraction costs with less effort.

2. Convex has no withdrawal fees and has the lowest cost (eg administration fees) compared to other platforms.

Convex charges 16% of LP, Yearn charges a management fee of 2% of LP and 20% of revenue.

3. CRV partners and financial service providers benefit from mining in the form of CVX.

Three.Symbolic economy

Token Name:

CVX

All supplies:

100000000

siv:

A portion of the proceeds and voting rights were obtained by staking cvxCRV.

Rating Type:

Gradually reduce the cycle to 3 years (130 repetitions per week), and after 3 years maintain a stable cycle (2200 repetitions per week). The inflation rate is around 4.5% per year.

The particular classifications are:

50% - Courbe LP Rewards

25% - Liquid Extraction

9.7% - Financial rates

1% - veCRV holders can request an airdrop immediately.

1% - veCRV Convex Instant Billable Airdrop List Holder.

3.3% - Traders

10% - Curve Team

Recent work:

Monthly Users:

Convex users have been rising frequently since May, hitting new highs in December.

Token value:

The price of CVX also reaches $53.62.

・CRV Lock Price:

Convex has maintained consistent and high growth in CRV stops since its launch in May.

concludes

Convex is Lego's DeFi representative and building block. Many processes continue to require personalized services, improving customer experience and reducing transaction costs.

Convex not only reduces initialization for users to quickly benefit from the curve, but also allows LP users to achieve better results through greater interaction and understanding. .

At the same time, Convex also addressed the issue of liquidity in veCRV. There was a slight failure in the exchange of cveCRV for CRV, but this did not pose a problem for liquidity.

Overall, Convex is a new DeFi 2.0 protocol.

Scan QR code with WeChat