Blockchain Consumer Behavior Reports: Next NFT and Gaming Trends

In 2021, the blockchain audience will grow. In the places that have evolved, the subjects of the category have brought in new people. Similarly, traffic to the global Dapp marketplace, DappRadar, grew 1,028% last year and now has nearly 1.4 million monthly visits as of end of 2021 data. With this audience in mind, we tried to identify the most important behavioral patterns of the last semester, which could become significant at the beginning of 2022.

By looking at a variety of metrics, we aim to understand key concepts and patterns in the blockchain industry over the past few months. industry.

In this report, we identify global events, including demographic and connection assessments, macros, and on-chain metrics to identify critical events in 2022 as behavioral patterns.

lift key

NFTs do not appear to be affected by the decline of the cryptocurrency and the numbers in the market continue to grow, while the UAW connected to the Ethereum NFT application has increased by 43% since the third quarter of 2021.

In contrast, usage in DeFi clearly deals with cryptocurrencies. More than 1.25 million UAW per day connect to DeFi dapps when all the time ETH, SOL, AVAX and LUNA are seen. As low as 800,000 UAW.

Despite the recent negative effects of cryptocurrencies, blockchain games continue to be widely used. Games account for 52% of commercial usage, linking the difference in usage with DeFi dapps.

China is now in the market, up 166% from November 2021. In 2021, the United States controlled the traffic.

details

Across the industry, Asia's footsteps have become more visible.

The Good News for Sports: Millennials and Generations Dominate the Blockchain Space

NFTs and games have proven to be stronger cryptographic protection than DeFi.

NFT Soap Explodes Even In Crypto Crash

Relationship between DeFi and macro metrics

Blockchain game rotation is stable

concludes

Across the industry, Asia's footsteps have become more visible.

By the end of 2021, the dapp industry was receiving over 2.5 million unique overnight (UAW) wallets. This level of use has increased by 707% compared to last year. The industry's rapid growth has been driven by a lot of interest, primarily from NFTs and games.

After reviewing DappRadar's traffic of 1.4 million visitors in December, we found detailed insights based on the current public census that would make the market look different from what we might have seen last year.

First, China now has the largest number of users. It has over 204,000 users, a 166% increase from the November subscription. Traffic from Indonesia and India was worth reporting, as both countries more than doubled in the past month. The Asian market continues to expand its presence in the industry. Due to the strong interest in blockchain gaming and the potential of NFTs, Asia is a region worth paying for.

The United States is not the main source of transport and is now only in second place after Asia. It is also the largest market for NFT products as a whole, with 38% growth in the US and hundreds of users. ~

England, Russia, the Philippines and Brazil fell to India, but still attracted large audiences. Traffic from these four countries topped 168,000 users and grew by an average of around 30%, with Russia seeing the biggest increase. ~

The Good News for GameFi: Millennials and Generations Dominate the Blockchain Space

In addition to our public reviews, we focus on the age group to better understand the blockchain audience. The integration of GenZers (18-24 years old) continues. In December, 30% of DappRadar traffic came from users in this age group, and their availability would reach 26% for most of 2021. The dominance of millennials follows the same path, accounting for 38% of traffic. This is a slight increase from the 36% seen for most last year.

On the other hand, the 45-54 age group experienced the largest decline and their share fell from 11.5% in January 2021 to 7% in December. With thousands of years of proven interest in groups such as NFT and Sports, both groups have a bright future. ~

Another presentation occurs when identifying items related to preferences. Despite the high number of visitors due to the release of the RADAR token, users are still logged into mobile devices up to 53% of the time. Most users prefer to use the desktop version of the wallet for security reasons, but desktop devices only receive 46% of the traffic. This could lead to a behavioral crisis that will become even more significant as this year has split into one of the biggest years for blockchain gaming. By 2022, mobile wallets (such as Ronin) and mobile blockchain games are expected to be more successful, so we should be wary of these models. ~

NFTs and games have proven to be stronger cryptographic protection than DeFi.

A year after three major dapp groups (TVL for DeFi, NFT exchange wrapper, and gaming apps) burst onto the top blockchain metrics, it looks like the store is finally ready to launch. However, macroeconomic events such as the recent COVID-19 surge, the Federal Reserve's primary focus on raising interest rates, and the oil crisis in Kazakhstan have affected nearly a fifth of mining in Bitcoin. The cryptocurrency market is once again stuck in a bearish cyclical run. ~

This article examines the impact of blockchain macro metrics such as the value of major cryptocurrencies, the value of Ethereum GAS or Bitcoin's Fear & Greed Index on chain measurement. How important are macro metrics to blockchain user behavior?

NFT Soap Explodes Even In Crypto Crash

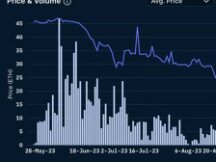

In Q3 2021, NFTs generated $10.7 billion in revenue. Fourth-quarter earnings of $11.9 billion were strong in the first 10 days of 2022. ETH, on the other hand, has seen no support since hitting all-time highs of $4,878 in November, or almost 30% at the time of writing. Although there was no change in the cryptocurrency cycle, NFTs managed to recover negatively. ~

Not only has the number of Ethereum NFT sales increased, but the number of UAWs connected to NFT dapps (onboarding and marketing) has also increased. Since December, an average of 46,800 UAWs have been connected to the Ethereum NFT dapp, up 43% from the third quarter figure.

Although the macro measurement is not good, the obvious role that NFTs play in the metaverse and the game led to a positive effect on the quality channel measurement. Additionally, create rolling plans to complement their strategic plans, improving the visibility of communities in the process. With the endless number of celebrities and big names, NFTs seem stronger than ever. ~

Also, metaverse detection can only support NFTs. The community is interconnected and many community changes, such as the old LookRare Marketplace, the power of the NFT Marketplace. Since the promise of such assets is undeniable, people will view cryptocurrency negatively, but as a term of purchase based on the value of the underlying asset (Ether in this information) reduces the true cost of NFTs . Although house prices fell, US dollar volume was still in sync.

Finally, the United States, which uses NFTs as storage, remains the most active region. The United States leads the DappRadar NFT vehicles, with Brazil and Mexico in the top four. A huge interest in sports, fashion and artists from around the world makes it a pleasant NFT space.

Relationship between DeFi and macro metrics

Despite the market after blockchain games and NFTs, the price set on DeFi sites reached all-time highs at the end of 2021. Competition in this category has grown significantly due to a variety of strong options , including attractive mining services. However, since there is no market more affected by cryptocurrency than DeFi, the on-chain measurement associated with DeFi along with the macro measurement can provide insights into behaviors and patterns. ~

Each asset is responsible for the total payload (TVL) of these blockchains, but not the usage. Correlation macro metrics such as Bitcoin's Fear & Greed Index (FGI) along with industry-leading usage indicate that DeFi is building on its crypto model. The FGI is an instrument widely used in the cryptocurrency industry that measures market sentiment on a scale of 0 to 100 and measures from horror (0) to extreme (100). ~

The two diagrams below show the relationship between FGI, the number of UAWs measured in the industry, and the number of UAWs connected only to DeFi dapps. There is no correlation between these two differences compared to the dapp industry as a whole. As mentioned earlier, NFTs operate autonomously in cryptocurrencies and are exposed to macro trends (electricity, development, case usage, etc.). The same goes for blockchain games. However, the situation is different in DeFi, power consumption and connection cost are good.

A closer look at the relationship between FGI and DeFi users revealed that in November, DeFi apps connected to DeFi dapps with AVAX, SOL, and LUNA generally hit an all-time high of 1.25 million UAW, respectively. . According to the refrigeration industry at the end of the year, consumption fell below 1 million UAW.

A similar situation occurs when identifying the three major TVL blockchains and their cryptocurrencies below. Starting with Ethereum, the cost of ETH does not interfere with the requirements for using NFT. As mentioned earlier, the use of NFTs depends on other factors. On the other hand, some patterns can be drawn as used in DeFi showing a relationship with the token value below.

How they use it in games and DeFi in BSC and how each affects the value of BNB. The UAW of BSC-connected DeFi dapps will follow a similar procedure for BNB tariffs. We have once again proven the relationship between DeFi and the value of traditional cryptocurrencies. At the same time, the use of the game does not affect the value of BNB. While BSC games rely on the game's native characters, some tokens like SKILL or JEWEL only affect the host app's usage, so it works more from a viewpoint.

A final example is Solana, where the property value, SOL, once again makes a strong statement about the use of DeFi dapps in the ecosystem. Comparing the use of NFTs in this network once again proves that DeFi user behavior is highly dependent on the cryptocurrency industry. ~

Blockchain game rotation is stable

DeFi and NFT follow two different paths. For DeFi, macroeconomic metrics play an important role in implementing this category. NFTs, on the other hand, seem to be more independent and macro events (in turn, micro-economic situations) affect the economy on their own. The same situation applies to blockchain games.

Over the past year, we have seen the rapid growth and adoption of blockchain games through descriptions such as financial games or metaverses. As with NFTs, these standards affect users and their behavior from the outside. In this case, the positive sentiment surrounding these two descriptions makes people want to join in the blockchain game. ~

By summer 2021, the game will pass DeFi as the most used dapp category. Both types of dapps dominated the market for most of the third and mid-fourth quarters. Nearly 90% professional use. However, when there is a negative cryptocurrency trend, the use of DeFi starts to decline. The gap between gaming and DeFi usage has grown since November, with gaming now accounting for 52.4% market share, while DeFi usage has dropped to 34.7%. In comparison, games and DeFi account for 46.5% and 41.4% of usage, respectively.

There is no doubt that the user base has grown as blockchain games attract more and more users every month. With revenue from games and GameFi options expected to be widely available in 2022, we can expect the gaming community to continue to drive commercial usage in 2022. ~

concludes

Behavioral patterns are enjoyable and help map out the differences that will lead to business success in the months ahead. Opinion polls show growing interest in Asian markets. Interest in sports and NFTs has increased. Age and equipment assessments can also help address short-term needs.

Combining macro metrics with string measurement can provide behavioral models. In this section, we can examine how NFTs and games work independently of factors affecting the market, such as global cryptocurrency exchanges and other metrics. NFTs and blockchain games will be strong in 2021, and these trends are set to continue. Especially when considering future projects and possibly the use of both ends. Although the value of cryptocurrencies is inherently volatile, the adoption, packaging and use of blockchain games and NFTs continues. It will be interesting to see if the development of these two entities includes the value of the base token. ~

Meanwhile, DeFi will continue to be after the cryptocurrency exchange. Not to be confused with spatial rotation. There is no doubt that the DeFi environment is more comprehensive and mature than it was a year ago, but it faces greater challenges than any of its peers. In addition to the burden of macro measures, rules and attacks from the usual public. Acceptance will begin. ~

Scan QR code with WeChat