DeFi 2.0 has just started. The first "fight" with is the area around the flow curve.

According to new data today, the entire NFT channel sold over $ 19 billion, and NBA musicians and stars from all walks of life and overseas entered a single later. In the NFT industry, fires have spread to other parts of the cycle as well.

The recent war around Circle's Curve has been going on for months without many noticing it. Today I will tell you about the circumstances of this war. Projects like Curve, Convex, Frax, Mochi (short lived), DOPEX and BTRFLY are happening one by one as stakeholders.

Today we're going to take a look at the first two, Curve and Convex, and discuss the next four players.

What is the curve?

The curve started to see solid results, simple pages, double-digit daily operations, but compared to Uniswap's easy-to-assemble XYK price curve,Curve's algorithm creates a much less stable coin slide than Uniswap., so everyone's position in the curve is an addition to Uniswap and a stable currency exchange for the big players.

Then after Curve was able to increase their income, machine guns like Yearn appeared and Curve became the most profitable region to support different machine guns. . Lower the price forever.

Since then, Curve has developed a pool of several homogeneous tokens (ETH promised as ETH2.0 stETH by Lido, in collaboration with Synthetix, etc.)Take advantage of the anti-slip features of SynthetixHe even took his share of Uniswap by creating three pools of BTC / ETH / USDT, the ability to trade BTC and ETH at very low cost.

However, none of them improved Curve's performance or routine costs.The Curve is also a refuge for big players and a breeding ground for many machine guns.. Until many cryptonative stability pieces appear.

The search for jobs is still in the normal and unstoppable cycle. DAI is not only the beginning but not the end ESD failure BAS AMPL failure has a future but also Frax (FXS), MIM (Spell), UST (Luna) and alUSD (Alchemix). , LUSD (liquidity) ……

This project is competing for the gift curve., and that's what led to the Battle of Curve Wars.

And to understand all of this, you have to understand the emission mechanism of the Curve.

1. What is veCrv?

veCRV received by the CRV lock. A CRV lock gives 0.25 VeCrv per year and up to 4 years for the whole VeCrv.

2. What is veCRV used for?

Price sharing curve

Curved media airdrops (eg EPS)

Increased Curve LP rewards (up to 2.5x)

But these are not very attractive.The most overlooked of veCRV, but now the most important is curve control.. Although the management may seem simple, the idea of DAO has been mentioned before, but in fact, a lot of people are not happy with the management. How many people were involved in the management of the DeFi project?

But when management is important it is about the income or the life and death of a project, so it is very important.

Calculated as the stability or lifeline of any new style of stability, and there are only two lives.

The first point is that greater use depends on the growth and expansion of the business activities.

The second point is that the exchange rate is not undocked and depends on the depth of the lake, it is only when users can trade Frax or Mim in their hands in USDT / USDC that it will slowly increase, this will help you. will put in confidence. . financial stability.

How deep is the lake? Count on a higher APY to attract more income. What's better, APY?Trust the veCRV vote! Yes, Curve votes every week., which determines the weight of the CRV donation output from each pool.

Higher APY pools always prefer more LP income to earn income, and more LP income as well.This means better depth, less exchange capacity and greater user confidence.......

After all, veCRV is the competitive target for every new generation of stable revenue and the single largest investment in the war of the curves. Finally, let's talk about the next Convex.

convex

What does DeFi World do best? You can refer to nested dolls for a reason.

Just as YFI can be seen as a puppet of Curve, AAVE, Compound, etc., Convex is the governing body of Curve.

What are you really doing CVX says it is difficult for users to run their own CRV, close a warehouse, vote, and store vegetables.

CRV players can save effort and earn money for a while. Why not?

All CRVs are provided by CVX, the contract is closed for 4 years., what you own is no longer VeCrv, but CVXCRV with a higher return rate than veCRV, and you can open the drain of your CRV lock through the CVXCRV / CRV pool. However, as much as the cost, the CRV settlement is gone.

So who manages multiple veCRVs in CLC? After all, of course, is the host of CLC. CLC holders can register CLCs for 16 weeks and earn vlCVX, then join CLC leadership and veCRV's commitment to distribute prizes to all pools on the curve.

So everyone knowsTo master CLC is to master it in the guise of veCRV., finally many CRVs registered in veCRV via CVX.

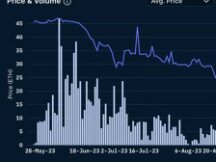

Smart gamers or businesses have the final say. It costs more to buy a CRV to get a veCRV than to buy a CVX, and we promise to use vlCVX for 16 weeks to control the cost of the disguised veCRV. CLC rates have increased in recent months.

So now CVX has its own Votium doll as well. CVX is the copyright policy for CRV or veCRV and Votium is the copyright policy for vlCVX.

You can do it hereAccept purchases from multiple secure sources using vlCVX in hand., and receive a reward in the name of your voting rights.

Knowing all this, the next chapter may introduce you to other players in this war.

Now the most powerful and stable Frax, the short-lived but well-performing Mochi, the future battle of Curve War DOPEX and the OHM BTRFLY fork are "vote to keep integration".

Contents

In this article, we have discussed the importance of controlling and voting for the curve, veCRV like Helen in the war that all parties fought, and the burden is real. And how to understand that Convex has become owner by consensus.

Scan QR code with WeChat