Deri Pool Outdoor is the first step of the DeFi 2.0 revolution in 2022.

DeFi 2.0 is a different solution from other apps that have been requested by these apps around the workload many times, but it is talked about more and more.

But it at least shows that the old DeFi protocol paradigm isn't worth talking about (are you still happy with AMM?) And that the new paradigm is still something to explore. .

Even though in 2022, if there is new development and gold in DeFi field, it is likely to happen in DeFi 2.0 project, i.e. new development project and the success of the process via DeFi.

At the start of 2022, the first manifestation of the DeFi 2.0 revolution was the start of the Deri V3 protocol, which brought an “external liquidity pool”.

DeFi 1.0 - Liquidity fragmentation

Liquidity across the macro-financial sector is crucial, especially for DeFi-based AMM contracts.

If the liquid pool is not very liquid, the product is depressed.

High slip means additional load and risk for the user, which makes them dissatisfied and ultimately forces them to focus more on liquid water, resulting in poor product quality.

On the other hand, this does not favor the DeFi protocol below: it takes a lot of effort to get users to invest in their own pool, and the most common and unthinkable way is to deposit multiple tokens.

It looks like an endless loop ... but no way.

AMM is fantastic, anyone can become an entrepreneur that only organizations can do in a minute, reducing access to business and increasing capital.

However, the liquid pool in DeFi 1.0 is still broken and isolated. Although "non-agent", it is still important to be governed by the DeFi protocol and the performance is still explosive for the whole market.

DeFi 2.0: Liquids industry

To solve the problem of water shortage, many projects have been carried out with new experiments in improving the efficiency of DeFi.

In the beginning, there were YFI type machine guns that first let water flow and then distributed it more efficiently, and users could also be supported by machine guns.

There is also Stafi, a contract that provides income for assets. The assets are still locked, but we tokenize them so that users can redistribute them.

Although these programs were criticized for not having puppy play when they first appeared in 2020, they have solved the problem of water diversification and improved the capacity of the entire market.

They are trying to improve revenue in the DeFi 1.0 era. They exploded in different DeFi. Most are turning to bicycles for buses, improving the scale to improve investment, but the proportion of water has not changed.

The DeFi 2.0 era is a further development of the direct-to-consumer product development solution, Liquidity-as-a-Service.

For example, Tokemak has recently been the subject of discussions as a financial provider for the DeFi protocol, including funding for Uniswap, Sushiswap, Balancer, and other protocols.

There's also Venus, introduced by Tianlian Teahouse, which appears to provide stable financial services and lending, but is essentially a profitable product that can open up liquidity pools for other DeFi protocols.

Venus was the first to publish the Deri (V3) protocol for external hosting design.

Deri V3: Introduction of external liquidity pools

Deri protocol is an exchange of different products, when talking about V3, we have to think about V2 and V1 first.

Deri V1 has heralded a future that is no different from other types of stock trading across the chain.

Deri V2 is the first to feature perpetual rumors, the world's first racing derivative of DeFi.

The Deri V2 also highlights a wide range of differential characteristics, the ability to perform well, multiple operating goals in a liquid pool, and more. In doing so, different assets were placed in the pool for storage and settlement.

This allows users to solve the problem of swapping different assets and improve usability (e.g. financial investment) while being a token support person carried by Deri V2 as long as they own the assets in a large company (either trader or LP). Anyone can join).

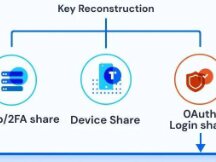

The liquidity in V1 and V2 remains in Deri's own liquidity pool, while V3 directly represents an external liquidity pool.

Whether users generate income with LPs or income as traders, the Deri V3 does not hang on to its pool, but to the business model.

In particular, Deri V3 can also release user security, then send money to the liquid market through outdoor swimming pool, security and Chinese users, time also benefits.

The advantage of this is that all tokens sponsored by the liquid market will automatically become tokens sponsored by Deri V3. Currently, the liquids industry, or another supplier, is Venus.

Of course, the capital held by consumers also has a positive impact on generating additional income in the liquid market.

concludes

Recently, several projects for DeFi 2.0 have emerged, all of which provide revenue-based services.

Adopting the Deri V3 not only uses the DeFi setups and additional basic features (like a machine gun with DEX support), but the authenticity of the product (this includes DPMM, which I will detail in another article).

I haven't seen the DeFi protocol which actually uses DeFi 2.0 except for the Deri V3 now.

Scan QR code with WeChat