Venture Capital 1 Member Approval: Approval for the 3 best products in the encryption industry in 2022

Last year I wrote an article on three unaffected products for 2021. Before I make our forecast for 2022, let me take a look at my performance. .

encryption technology

Content: yes

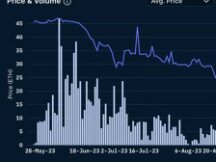

NFTs and crypto technology have been the subject of a lot of reviews this year, but what the picture is, those are the best details of what the site is.

Source : https://cryptoart.io/data

Let's take a look at two sentences we wrote about our forecast for 2021.

“The DeFi Supreme List now considers NFTs to be toys. It reminds me of the BTC 2018 Supreme List denied by dApps. DeFi influencer Twitter, who reported on NFT publicly a year ago, suddenly appeared and took a 180-degree turn. tig. He began to promote change and the hype. From PFP to NFT financing. “Currently there are three artists with a total value of over $ 1 million and 43 artists with a total value of over $ 100,000. We hope to see more of that number by the end of 2021. ”—— Today there are 4 artists worth over $ 100 million, 46 artists worth over $ 10 million, 268 artists worth over $ 1 million dollars, and 1,283 film artists worth over $ 100 million. US $ 100,000 or more.

business forecast

Conclusion: not clear

From the 2020 US Presidential Election to the start of the celebrations, packaging activity on Polymarket in January has skyrocketed. Trump supporters who believe in #stopsteal continue to buy Trump shares at prices ranging from $ 1 to 10 cents, giving believers another 10% "arbitrage" time. However, with the exception of occasional events such as major global political events, it is difficult for industry estimates to support volume. I think both business speculation and community relations are deadly for cryptocurrencies, but the real estate market is still a long way from where I was supposed to start.

DeFi Derivatives

Content: yes

I tweeted the popular idea that 2021 DeFi has reached the point of either adding feature enhancements (i.e. better fixed funds to replace old ones) or copying Ethereum's work for another. L1.

One of the few new 0: 1 releases we've seen on DeFi this year has focused on devices. Index Coop and Ribbon have developed raw materials to provide risk aversion and recovery strategies. Notional reported stable loans. But more importantly, the two major changes to DeFi this year are Uniswap v3 and Primitive.

Uniswap v3 redefines what it means to be a liquidity provider, rethinking the efficiency of investments rather than pinning the total cost as a KPI for DeFi projects, and launches an ecosystem of standard products such as formatting boards Gamma for Uniswap. Since the release of v3, Uniswap's DEX market has generally gone from 45% to 75% (Sushi has gone from 24% to 12%). This is because the volume converges to the best AMM.

Primitive was also the first to complete a developer cloning project. Considering the prospect of recovering from a particular financial need (e.g. options, trades), a co-working curve can be designed to replicate this practice in the AMM space of the business center. It's huge with the DeFi option. Chain tradfi options are difficult to replicate as options are the latest category of DeFi without a clear industry leader due to oil and liquidity dispersion and other reasons. Going forward, we believe Primitive will replace existing options, as Uniswap did in its previous DEX order books (like EtherDelta and Radar Relay).

An overview of our product portfolio is not expected for 2022

Vertical specific NFT markets

OpenSea is clearly the biggest winner in our portfolio. While it continues to be a business today and becomes the leader in the NFT aftermarket, I believe specialty retailers will open up niches with better UI / UX and research and development capabilities. performance. SuperRare is a great example of 1/1 crypto art, but it also has other features like video (like Sloika), meta-universe (like Metahood), and music (like catalogs). .

Separated from the Craigslist infographic, web2 VC likes to be used to provide insight.

Specifically, I would focus on NFT music. Unlike other things like art, writing, and games, NFT music is always uninterrupted, but the tastes of writers seem to change quickly. The premium NFT music catalog hit a big milestone in October, and its easy-to-use packaging graphics remind us of what we saw of SuperRare before the crypto-art explosion in early 2020. In Music , it's just a matter of "when", not "even".

Cross chain bridge with little faith

Now almost every chain link is a different type of multi-signature. In particular, Ethereum for Avalanche Bridge, an Ethereum External Address Account (EOA), has private keys distributed to four Intel SGX subscribers and has over $ 6 billion in users.

These Bridges are big honeypots, and we expect the Bridge Chain Hackers to become the new CEX and DeFi Hackers. The $ 611 million poly network hack is just the end of the future iceberg.

Fortunately, there are many low cost, high reliability bridge products entering the market. Hop is now a leader in expansion of trust-building equipment, reimbursing parties at all levels by exchanging MAs using fixed funds with traders. So far, the importance of bridges has led to the token exchange, but the holy grail and the area that is currently the subject of major research will change the chain's case in disbelief. Connecting these channels will lead to many new users. Smart contracts in DeFi operations on Ethereum L1 can be called smart contracts on L2 or side by side.

Invest in DAOs

I like to think of investing in DAOs as a collector's team rather than a work of art. The problem with NFT segmentation that I noticed is that the fragmented tokens (ERC-20) do not change as below NFT (ERC-721 or ERC-1155). Therefore, holding fragmented tokens as cheap indices exposed to blue chip NFTs (like cryptopunk) is incomprehensible.

FlamingoDAO is by far the best investment DAO, and we've also seen DAOs start to apply for major purchases like the US Constitution and Ross Ulbricht's work. The current process includes the use of Gnosis Safe, but we hope that better tools like Koop will make it easier for groups to buy more expensive NFTs. 99% of NFTs won't keep their price for the long term, and expensive NFTs (CryptoPunks, Bored Apes, etc.) will keep their best value, which is open source. Investing in DAO is the cleanest way to give the public better access to high-end NFTs.

The assumptions of the texts contained in this political narrative are those of the original author and do not represent the position of the Metauniverse. Investors should not regard the assumptions and conclusions of the document as a material factor in making investment decisions, and they should not consider the assumptions and conclusions of the material in the publication to alter their order. Investors should consult experts if necessary and make an informed decision before making an investment decision.

Scan QR code with WeChat