A further change is in the testnet compared to AMM-Timeswap of Uniswap, a lender led by Multicoin.

Stimewap is a recommended design in ERC20 of the benefits of ERC20 standard. The current network test is a network level from multiple numbers.

1. Present the project

Timeswap is a contract developed by Ethereum for the secured lending and borrowing of standard ERC20 tokens.

The automated business algorithm of the 3-media automation product used is based on Uniswap's continuous 2-variable model.

Timeswap uses three different AMM market shares to calculate interest rates and the price of a commodity, which helps determine the interest rate before a market occurs, while providing solutions. The problems are easier for borrowers and mortgage lenders.

Like other DeFi devices, it's non-binding, non-transferable, and uncontrolled.

However, unlike other DeFi loan services, Timeswap eliminates penalties and employee trust and does not require a theme.

Timeswap also allows debt consolidation campaigns with tokens to be available as a liability, which can be very lucrative.

Second, tracking

Into the heart of loan.

Third, responsibilities

Customized loan interest, safety rates (negative payments, mortgage) are the most important events.

Each loan pool in Timeswap has three main characteristics: one is the ERC20 token which is borrowed and borrowed, the other is the ERC20 token which is used for trading, with the expiration date.

Our forum meeting at Timeswap Pool is all about lenders, lenders, and startup finance.

Getting loan

Borrower deals with Timeswap pool, assets are ERC20 A tokens, collateral is ERC20 B tokens, term t.

Borrowers can adjust the risks and rewards they face, the higher the annual interest rate (APR), the greater the need for growth and the lower the security.

As it grows, the lender will regularly receive a large amount of interest.

If a borrower is in the pool first and the value of borrower's token A decreases, the borrower can file a claim against the borrower illegally token number B, protect the lender from the risk of default.

The person borrows the thought

In the timeap pool where the borrower interacts with the borrower, the borrower must close token B and remove token A from the lender.

Borrowers can adjust the percentage of their loan tokens, and the higher the value of the collateral, the lower the loan.

To withdraw token B token, which is closed at the end of the term, you need to pay the tuition and interest on token A. If the borrower is not legal, token B token is distributed to the lender.

liquidity service

The Liquidity Service (LP) started Timeswap Lake by providing the first well for Timeswap Lake.

LP is viewed as both the borrower and the lender. Token A deposits so that the first borrower can borrow money.

Likewise, it closes token B as a liability and uses token A as an expense to support future contracts that the borrower receives.

4. Terms of the contract

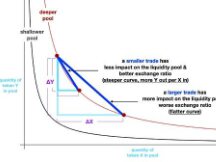

The best feature of Timeswap is its 3 different continuous AMM models: X * Y * Z = K.

This is the bottom line in which Timeswap favors interest rates and risk levels.

Then take the image below as an example.

X = The main pool is a virtual lake as the number of assets that can borrow in the pool.

Y = Interest rate Since the swimming pool is a virtual swimming pool which determines the interest rate per second in the swimming pool, the Y / X ratio is the maximum interest rate per second in the water.

Z = Collateral Factor Pool is the pool used by lenders to determine the asset they wish to close so that the Z / X ratio is the Minimum Expert Technician Pool (CDP).

K = product of inconsistency

There are also two lakes.

C = Deduction balance, equal to the number of ERC20 payment deposits in the loan locker.

A = Asset pool, equal to the number of ERC20 asset tokens locked in the pool. These are income from loans owed by the borrower and expenses owed by the lender.

find the value

In these models, when interacting with the pool, credit and debit can be exchanged over X, Y, and Z so that the constant K material is always stored. This allows interest rates and borrowing costs to be incurred during the market period.

Loans:

The borrower increases X by adding assets to the main pool. In order to keep the stock running smoothly, Y and Z will decrease, which will reduce the interest rate and insurance of the next borrower.

Bad flow:

The borrower will remove the property from the main pool and reduce X. If the property remains unchanged, Y and Z increase, resulting in higher interest rates and better insurance.

Simple scary level

The AMM system is convenient for the end user because the user can determine the risk-return ratio and set the APR for each loan.

Bad flow:

The lower the APR, the more assets are locked, and the higher the APR, the lower the assets are locked.

Loans:

The lower the APR, the higher the insurance premiums, and the higher the APR, the lower the insurance premiums.

Fifth, target consumers

1. Regular users with different loan requirements:

We provide loan services to lenders and risk takers with different loan rates and risk levels.

2. Consumer business needs:

Holding company management tokens are a less expensive option.

3. Credit-based financial group:

Use for personal reputation token system, credit score token system, etc.

4. Users with expensive NFT tools:

Users can split their NFT into ERC20 tokens and use it as a lease to get loans.

6. Industry standards

Token name:

time token

siv:

LP payment and price contract, good partners, future supplies and DAO management.

The distribution and classification have not yet been disclosed.

Proterozoic period

Timeswap ERC20 tokens still below can be redeemed on the second transaction to complete the transaction except for using a working platform.

Bond Jeton (BT)

ERC20 tokens, contract tokens are used to advertise loans. Lenders can use BT to swap loans for interest after the loan expires.

Insurance token (TSI)

ERC20 tokens, insurance tokens can be used to provide loans. If the borrower cannot guarantee enough principal and interest from BT, he can swap the IT for similar equipment.

Secured Debt Token (CDT)

ERC721 Token, i.e. NFT Mode. Mortgage rates are provided to borrowers who invest in the business and borrow pool assets.

The borrower must repay the pre-development debt and then use the CDT to repay the closing stock. If the borrower does not repay the debt, the property is transferred and distributed to the borrower.

Liquidity Token (LT)

It is an ERC20 token, i.e. Timeswap's LP token. Liquidity tokens are provided to Liquidity Providers (LPs) who add assets and evidence to the pool.

Providers can include their pool with LTs as proof of their assets, after expiration and consider the borrower's solution, these LTs provide a percentage of total Great Lakes and collateral lakes assets.

Seventh, team information

rickson qog

Formerly the founder of Einstar. MSc in Financial Studies from Ateneo University of Manila. He's a self-help group producer and former editor for one of Udemy's most popular contractors. He is also a serial entrepreneur in education and hyper-large e-commerce.

Ricsson took inspiration from Uniswap and in late 2019 began building the unlicensed and trustless fiat currency market, which led to Timeswap.

Harshita Singh

Formerly Director of Financial Planning and PB Planning for Walmart-India.

He is a graduate of the best university in India and winner of the 2020 ETHIndia Hackathon. Here we have created the SaviFi file transfer protocol.

Devada Friends

Previously, he was Director of Product Management for Aurigin Financial Technology Company, the world's largest financial investment platform.

Before that, he worked as a banker for a financial company. He joined Crypto for over 4 years before deciding to call on his experts to join Timeswap.

8. Contractors and consultants

Investor

Exchange seed round budget:

The investment was led by Multicoin Capital, followed by Mechanism Capital and Defiance Capital.

Join the wheel of angels:

Balaji Srinivasan, Surojit Chatterjee, Mihailo Bjelic, Ryan Sean Adams, Alex Svanevik, John Lilic, Julien Bouteloup, Larry Cermak, Mika Honkasalo, Kenzi Wang, Calvin Liu, George Lambeth, Vaibhav, Sina Habibian, Tanmay Kimket Bhat, May Kurana

Advisor

Sandeep Nail Page

Financial advisor, co-founder of Polygon Chain

Yanty Kanani

Co-founder of Polygpn

Scan QR code with WeChat