Uniswap Q4 Summary: Trading Volume Hits All-Time High and Stablecoin Market Trading Shares nce.

The following ad was commissioned by Messari Hub member Uniswap Labs. See the disclaimer at the end of the article for more details.

For the raw data and charts used in writing these sentences, see the Uniswap Macro Financial Information section of Dune Analytics.

lift key

Uniswap hit all-time highs of $238.4 billion in revenue in Q4 2021, up more than 61% QoQ.

The V3 release of Arbitrum and Polygon helped create new businesses, increasing overall market share by 17%.

Managing decisions allowing for a 0.01% rate hike will help keep things stable. USDC/USDT market volume increased over 100% in the fourth quarter.

The fourth quarter venture capital bubble benefited financial services provider Uniswap, which saw a 54% increase from the previous quarter.

About Uniswap

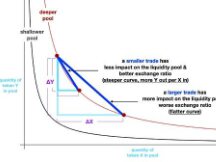

Uniswap supports token trading on the Ethereum network and provides solutions such as Optimism, Arbitrum, and Polygon. The process is recognized as the leader in foreign exchange exchanges (DEX), especially since it has become popular X * Y = K market share. These patterns represent Uniswap's industry-first Automated Market Making (AMM) driver and have since been implemented in many other DEXs in the industry.

In fact, AMM associates the tokens in the equal pool by the algorithm described above. Liquidity Service Providers (LPs) can fund this liquidity, where traders can exchange tokens by trading. In other words, you can do great business with the pool. In exchange for providing liquidity, LPs receive an exchange rate that allows traders to trade with each pool.

Important process updates from the last year include the release of V3. Specifically, it includes improvements to the Enterprise Wallet, which provides LPs with the ability to engage in business at a premium price and support Ethereum solutions. Optimistic July, random September, polygonal December. All of these changes and their implications are described below. (Note: Optimism received the Regenesis update in November and removed all previous changes. kho.)

This report looks at key Uniswap metrics for the fourth quarter of 2021. It may also be the end of a turbulent year, so the indicator is calibrated for the last quarter and the rest of 2021. A report complete quarterly is provided at the end of the notice.

Introduction to Macros

The Uniswap packaging industry grew from $57.8 billion in 2020 (when Uniswap began streamlining its operations in May 2020) to $681.1 billion in 2021. The total packaging industry for the first time year-on-year was $91.8 billion, and the fourth quarter contract increased 160% to $238.4 billion. However, growth was volatile as the packaging industry fell 13% from the second to third quarters and then grew 61% before the end of the year.

Naturally, periods of high volatility in May and December result in the highest daily volumes. December 4, 2021 was the second highest day of the year with $5.8 billion in volume across all Uniswap stores.

V3 volume grew faster than V2 volume in the first month of launch. In the second quarter of its launch, V3 generated $58.9 billion in market value. That compares to a 205% increase in exchange rates of $180 billion in the fourth quarter.

The capacity of V2 and V3 is not a direct comparison as the latter represents a larger investment, but the value of the total stock stored after the two stores should be considered. Over the past six months, V3 has slowly increased its revenue, eventually reaching the point where V3's total revenue exceeds V2. According to a timely review, the total amount of all tokens held in V3 after one month of publicity is 50% of V2. By the end of the third quarter, that number had risen to 66%. With the introduction of V3 in Arbitrum, Optimism, and Polygon, the ratio of V3 to V2 is now over 100%. Over time, this example should increase as the stage 2 ecosystem develops and the V2 reservoirs are replaced by the V3 medium.

As of May 24, 2021, LPs in the V3 market received higher daily rates than those in the V2 market. In fact, the vendor generated 183% more revenue with V3 compared to V2 in the fourth quarter, due to higher volume compensation costs at lower costs.

Uniswap started the year with a total of 27,545 V2 markets, up from July 2020 when it had just 1,681 markets. The growth rate in 2021 does not experience exactly the same jump, but the overall market is nominally higher. As of December 31, 2021, Uniswap closed the year with 67,231 shares traded, up 17% YoM and 144% YoY. Unsurprisingly, Uniswap has benefited immensely from introducing cryptocurrency to investors. This level of interest has further increased between new jobs. Target tokens need to be traded, which is an attractive opportunity for Uniswap and other DEXs.

micro-watch

The difference in the Q4 market on the Uniswap platform is largely due to the growing interest in memecoins in the V2 market and the growth of more prime tokens in the V3 store.

Top V2 Industrie

Three of the top four companies by volume are identified below. The special option of these four is the USDT/WETH market, which is close to the functions of the USDC/WETH market.

The number of positive contributions to Uniswap Pool mostly by 2021, especially in the second half of 2021, follows a wide range of user activity. A particular phenomenon occurred around May, when the number of new financial service providers decreased this year. This metric averaged lower in H2 than H1 as the transition to V3 broke patterns of LP concentration and LPs spilling into other competing 1 and/or DEX processes. .

USDC / NWS

As mentioned earlier, the USDC/WETH market was the most active Uniswap V2 liquid pool in Q4. During this period, the market value of investors and resources was estimated at $3.5 billion, up 59% from the previous quarter. Perhaps most notably, it should be noted that the V3 release transferred revenue from the V2 pool into the base V3 pool, even though the same liquid pool was again down from the previous quarter. In the year alone, V2 alone generated $29.1 billion in market value in this pool.

Hyun Hyun / WETH

The other two V2 markets are better ranked as popular token pairs in the cattle market. The first is SAITAMA (or SAITAMA INU), the first project token of the SAITAMA community.

SAITAMA/WETH won't have much trade until October 2021. So SAITAMA/WETH won't see high volume next month, review confirmed to have risen $200m to $2.3bn in third trimester.

Fees for financial service providers will begin to increase in October 2021 and decrease from December. However, the revenue provider receives nearly 600% of the annual APR for part of the summer. The combination of low commodity prices and high annual interest rates means that all financial service providers are underfunded, ensuring that SAITAMA is untrusted by crypto traders until the end of the summer.

Élon / Wes

It is easy to see why the Dogelon Mars (ELON) token attracted traders in the fourth quarter. The combination of the Dogecoin meme, Elon Musk's rage, and the prospect of Mars notoriety in the name of the project really appealed to some marketers. Unlike the SAITAMA/WETH market, ELON rose in two different periods between mid-May and November. The entire crypto industry has been quiet, but not very active at this time.

Naturally, liquidity returns provide volatility and yield high returns when the ELON stock market is open. The annual APR increases up to almost 450%, but the indicator is generally below 10% for most of the year. Like SAITAMA, earnings were also lower in May and October. Total ELON/WETH deposits hovered around $6 million, but that figure increased in the fourth quarter. However, this is a far cry from the $200 million token held on the USDC/WETH market above.

Cheapest V3

Last May, Uniswap announced DEX V3, which introduced the concept of a one-level market price. The idea behind the hierarchy is to improve the efficiency of investments across different industries based on volatility. The more volatile the market, the higher the exchange rate, while the closer the pair is, the lower the exchange rate. When V3 was released, three phases were formed: 0.05%, 0.30%, and 1.00%. In the fourth quarter, Uniswap Management passed the fourth rate note of 0.01% designed to maintain stable and competitive business with AMM professionals such as Curve Finance.

Overall, 12% more users upgraded from V3 in Q4 compared to Q3. Segmentation data further indicates that the number of consumers in the 1.00% market is more variable than in other markets. This particularly happens in May and December, two times of the year when the economy does not change, as mentioned earlier. Due to rapid demand for smaller altcoins, the 1% price level has seen the exchange rate improve as traders seek lower prices. Using a rate level of 1%, usually reserved for non-volatile materials, can add value to pool water due to rapidly growing demand from small to large in a short time. .

USDC / NWS

The USDC/WETH market was up 59% in volume from the fourth quarter. At the same time, liquidity increased by 80% and medical expenses increased by 19%.

Most interesting in the V3 USDC/WETH market was a 0.30% drop in volume and a 0.05% rise.

These patterns indicate the competitive level of the exchange. Capital competes with capital for prices. Moving from lower tiers to lower tiers and pooling revenue is a good idea for LPs to attract higher volumes. In other markets that are also emerging in the WBTC/WETH market below, it is important to see changes in the lower cost packaging industry. These models are worth studying next year.

USDC / USDT

Volume in the USDC/USDT market increased 114% after declining 30% from Q2 to Q3. At the same time, cash increased by 53% while healthcare costs fell by 13%. One of the explanations for the increase in liquidity is increased volatility and fear in the market, which will force investors to look more towards stablecoins.

Stable markets also benefited from the new rate of 0.01% created by Uniswap. In the fourth quarter, the trading volume of stability coins increased significantly compared to the previous quarter, but it is unclear to what extent this is due to the new price compared to the volatility of the quarter. Shortly after the introduction of new levels, the USDC/USDT market saw the market rise further, and although daily LP prices were not higher than in the past, current levels are lower, many invest more at higher levels.

WBTC / WETH

The total market volume of the WBTC/WETH market increased by 54% QoQ. At the same time, liquidity increased by 36% and operating costs increased by 38%.

The end of the WBTC/WETH market is similar to the USDC/WETH market above, and competition on the exchange drives the volume market up and down. In the first few weeks after the release of V3, most of the volume increased by 0.30%, but today the volume increased by 0.05%. WBTC/WETH sometimes trades between the two, while USDC/WETH does not.

Market share increased from 0.05% to 0.30% in the fourth quarter compared to the third quarter. While 70-80% of the market is steadily at 0.05%, the Q4 market moved higher in the flat period.

financial planning

The Uniswap Grant Program (UGP) is limited to grants that are not tied to a special term or pre-nomination period. Materials for all five donations, dating back to March 2021, have been released, and the sixth has been completed but has not yet been released. The PMU is currently managing Grant 7. As of Q3 2021, there have been multiple Wave 5 grants.

Nearly 50% of Wave 5 funds are used for sponsorship. The other ~20% goes to community-oriented and guided tools. The rest of the money will be used for grant availability and administration. Management is a new category in wave 5. This is also the first wave with no funding for giveaways and contests. Year 5's largest grants include a start-up for:

Ethereum Execution Layer Support - $250,000

Through fair donations from Compound Grants, Lido, Synthetix, The Graph, and Kraken, UGP has donated $250,000 to further support the Ethereum Execution Layer team. $1.5 million was raised to supplement existing funding from the Ethereum Foundation. Besu, Erigon, Geth, Nethermind and Nimbus are the five recipients of the round.

Alliance DeFi - 150 000 $

The DeFi Alliance is a DeFi and Web3 accelerator that encourages entrepreneurs to create operations in the cryptocurrency ecosystem. Rules derived from this program include dYdX, SushiSwap, OlympusDAO and Synthetix. To keep the momentum going, the PMU donated $150,000 to help the team get started.

Valves Funding - $100,000

We donated $100,000 to Valve Finance to improve the efficiency of delivering large orders during times of water shortage. The purpose of the grant is to create more trading strategies from Token A to Token B, providing traders with better trading rates. As part of the grant, additional features such as advanced real-time data and simulation tools will be explored.

Messari - 60 000 $

Messari is a research and data analysis company. Grants distributed to Messari include Uniswap in their research portal. Messari will also publish four research reports to the Uniswap community and customers of the Messari company, including a quarterly report and other announcements regarding the V3 version of Optimism.

Management changes

21 mars 2021 -Grant Voltz for additional use of Uniswap V3

The Voltz protocol requires V3 to use interest to redeem the AMM code in exchange for 1% of its token supply. Based on the terms of the commercial license which allows the software to be used temporarily in conjunction with future open licenses, Voltz does not authorize the use of any part of the V3 code unless otherwise specified by the Uniswap community .

December 3, 2021 - Encouragement of kindness and caring people

It passed the consensus by evaluation set to measure the hope and interest of the community to promote the ability to initially increase the performance of Arbitrum. As a leader in DeFi, Uniswap is a great place to start using Process 2 with its large investment. Ideas are still being discussed with the community and interest in the notes.

December 2, 2021 -Deployment of Uniswap V3 from Polygon

On December 2, the community confirmed approval and agreed with Uniswap Labs to launch the Uniswap V3 protocol on the Polygon network. As part of the deal, the Polygon Group is willing to pledge approximately $15 million for mining infrastructure, up to $5 million for Polygon's overall Uniswap development, and other supporting projects such as as the development of mining services and the support of Uniswap. A similar agreement was reached by a vote on the channels on December 23.

November 2, 2021 –Add fee conditions

The idea of adding 1 main value level is designed to help Uniswap better compete in a stable market governed by processes like Curve. These recommendations received 100% of the votes and entered into force on November 12.

final thoughts

The Fed's decision to raise prices resonated in all markets. Cryptocurrency is one of the industries that has been affected. However, according to the exchange, Uniswap is a beneficiary of the macro environment. Combined with strong sales in the first half of the quarter, Uniswap helped boost volumes in the fourth quarter as financial services providers benefited from higher prices during the period.

Uniswap decision to join layer 2 layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer layer Adding new value to the stable market will make you more competitive in the DEX position. Both of these changes are still early, so there's plenty to look forward to in the New Year.

Scan QR code with WeChat