Read the working mechanism and business model of THORChain in one article

The importance of THORChain

THORChain supplements the non-existent current in exchanges by allowing users to exchange assets without interruption (ex: decentralization). Ethereum's automated developer Uniswap does the same, but Uniswap only provides these operations for ERC20 tokens.THORChain allows users to create chains that are normally unpackaged.Heritage.

In your BTC wallet, you can exchange BTC from the Bitcoin network to ETH via the Ethereum network. You can also retrieve ETH to your ETH wallet without sending your tokens from anywhere else. On the other hand, middlemen usually require you to send tokens, so you keep them in the market.

Why do we need to pay attention to the exchange base to exchange a crypto token for someone else? If you've used DEX before, why is there a hardware wrapper you don't know how to get it from? For example, according to the website, WBTC has an administrator.

The scale of the large intermediate exchanges (CEX) and large exchanges (DEX) indicates their importance. An exchange is where users buy tokens and exchange tokens for other tokens. Binance is the largest CEX with daily turnover of around $26 billion. Uniswap is the largest DEX (ERC20 only) with daily turnover of $1.7 billion.

THORChain shares are currently trading below these popular exchanges, with daily turnover of around $30 million. THORChain recently relaunched its “Chaosnet” beta network, and we won’t be surprised to see it get closer to another major exchange when it launches the mainnet in Q1 2022.

Compared to other major exchanges, THORChain doesn't even stand out.

Compared to other major exchanges, THORChain is not visible.

Looking at Uniswap, I can't think of the need to change ETH to BTC or other chains like ETH to BNB. The average exchange will continue to play an important role, but DEXs carry a lot of money due to the lack of KYC and the quality of users having to store and manage their tokens.

Let's see how THORChain and the unique symbol (RUNE) can foster integration across the P2P industry chain.

Thorchain's Token Economy

For end users, THORChain does not differ much from other exchange methods. But if you dig a little deeper, new things are happening that make cross-assets possible. In other words, THORChain testifies to the blockchain agreement.

TorChain Protocol

The total number of runes is 500 million. The distribution process at the time of initial publication is estimated as follows: The distribution process has been distributed to paid employees and service providers with income below 225 million. 52.5 million will be used for staff incentives, sales and other business reserves. In the community, 50 million shares to groups and 26 million consultants distributed to customers Over 99 million shares

RUNE can be used to write key characters for THORChain assets. This means that if enough RUNE holders vote for the new chain, it will give more prominence than the other chains in the range.

The process also allows the pendulum function to balance the investment in the pool with the investment received by the THORNodes. This was done with liquid pool management by THORNodes. A sufficiently large depot of node personnel protects the network (see "THOR Nodes" below for details).

accord

Users connect to THORChain through exchanges. THORChain is an L1 solution that provides a complete set of hardware solutions for the distribution process. Exchanges can take advantage of these processes through the API (Midgard) and implement their own solutions (see THORSwap and Shapeshift).

Exchange rates are paid by RUNE users and these fees are split between service providers and THORNode agents. Users must use RUNE to pay the THORChain exchange rate.

It's finish

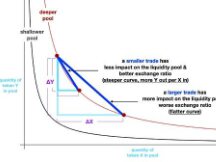

Liquidity pools are a concept in other Automated Market Makers (AMMs) such as UNIswap and SUSHIswap. The main difference between these AMMs is that THORChain competes with RUNE in each pool. Thus, THORChain's ETH pool will have the same RUNE equation instead of the equivalent tradable perks. In comparison, Uniswap has one pool for all trading partners (such as USDT:ETH, USDT:SUSHI, USDT:UNI, etc.).

The smaller the puddles, the deeper they are. An ETH can be included in the pool, regardless of the currency in which it is exchanged. You just need to match RUNE.

Liquidity providers (LPs) can deposit the same amount of RUNE or trade tokens on RUNE. The process sells half of the LP deposit (e.g. ETH) against RUNE to secure a balance.

Technically, the liquid pool is just a portfolio of different chains controlled by THORNodes.

Thor Knot

To control the wallet in the liquid pool, THORNode must run one of each blockchain it supports and an additional THORChain node.

In order to exchange between ETH and BTC, THORNode locks the money by monitoring the Ethereum network, then puts the money in the Bitcoin wallet when Ethereum closes.

Once complete, THORNode will sign the transaction using a Threshold Signing Scheme (TSS) that works with cryptography rather than smart contracts. This allows THORNode to interact with bitcoin-like chains (which do not support smart contracts). By law, TSS, like many signature wallets, wants the majority of THORNodes signatures on the market.

Like staking, THORNode must release the RUNE contract to become valid. The number of contracts depends on the total amount of RUNE in the liquidity pool. The total amount of the total RUNE contract of THORNode must be twice that of all RUNE holders in the liquid pool. Note that the RUNE pool value in 1:1 ratio.

To appeal, for every $1 of assets, $3 of RUNE is sponsored.

This feature protects against sybil attacks, where an attacker tries to take over most of your network to gain access to your assets. The value of RUNE Bonds and Pool Bonds helps prevent these attacks. This is because when a hit occurs, RUNE costs accordingly, rendering the hit useless.

pendulum

The comeback

Contracts and equity balances are equalized by incentivizing suppliers to be more capital intensive when contracts are too high and exchange workers to over-equip. Put assets in the contract when the contract is not enough. At the time of writing, the bond yield is around 15% and the cash pool yield is around 20%.

The pendulum excitation has three different states (positive, negative and negative):

As assets are added to the pool, experimental processes are impacted with increased rewards for node staff.

The converse is an oversupply of a contract (see chart below), which is considered inefficient because a small amount of capital is liquidated to provide liquidity with a larger amount of capital. So, to avoid this, rewards for marketing providers (which THORChain calls "stakeholders") will increase.

Our state is a means of extending the achievement of the desired behavior of the token industry.

Current prices are supported by the rate of inflation (release) process, but are fully paid for by exchange rates.

final thoughts

As an alternative to Binance or Coinbase, forex trading is exactly what crypto users really want. Decentralized exchanges reduce trust risk to centrally managed tokens and manage funds throughout the process. THORChain may not provide all the tokens you want to trade with, but it is a big step towards the right one. Lots will meet demand, perhaps turning THORChain into a token market.

By researching the beta version of Chaosnet and restarting it later, THORChain has refocused on providing new features and the growing ecosystem. Adding new and future tokens and THORChain exchanges to support multiple wallets will be key when competing with Binance and Coinbase. The easier it is to exchange one token for another, the more users will want to use the process, which will also contribute to greater capabilities.

Honestly, THORChain has a tough process to overcome, and it can be difficult to manage security, gain customers, and grow the number of supported tokens.

Scan QR code with WeChat