Veteran Wall Street trader analyzes why Bitcoin can hit $ 80,000

Former Wall Street trader Wilfred Daye (Wilfred Daye) runs crypto firms such as OkCoin and Enigma Securities.

Daye, now the head of Securitize Capital, recently shared with Insider his thoughts on cryptocurrency for 2022.

It discusses the estimated value of key assets and key topics to look for in the coming year.

After years of phenomenal growth in the crypto industry, investors are eager to see what 2022 brings to the market, which is still in its infancy.

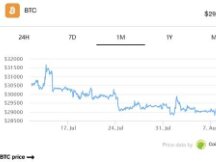

Bitcoin (BTC) is expected to rise 60% in 2021, hitting risky assets, including the Standard & Poor's 500 index, which rose 27% last year. On Monday morning, the largest cryptocurrency was trading at around $ 46,993 in New York City, according to CoinGecko.

Going forward, investors and analysts agree on the continued use of cryptocurrencies by organizations and retailers. However, Omicron's rapid diversification growth and tighter rules for global financial institutions have affected the shape of income for large crypto assets.

In the United States, the Fed, struggling with inflation for 40 years, plans to cut its contract this quarter and could raise rates from March. This is considered a major head for the cryptocurrency market, with some predicting a longer-term slowdown.

On the other hand, many traders predict that Bitcoin will be decoupled from tokens that support positive values such as financial transactions and non-fungible tokens. For example, the traditional ETHereum (ETH) token outperformed Bitcoin with gains of 392% last year. Other smart contracts, including solana (SOL) and Avalanche (AVAX), also performed well last year at around 9,568% and 3,111%, according to data from CoinGecko.

To gauge the expert's perspective on the future of the crypto industry, Insider interviewed Wilfred Daye, a former Wall Street trader who recently served as CEO of crypto firms Enigma Securities and OkCoin. Securities.

Daye joined digital asset firm Secureize last October as head of property management. The digital asset management company doubled its revenue from cryptocurrency income and recently partnered with Standard & Poor's Dow Jones Indices to symbolize the two earnings.

Date shared his thoughts in an email on December 23. His responses have been edited slightly to be clear and spaced out.

As markets enter the Red Sea, many are predicting another crypto-winter. How do you understand the business environment now?

I haven't seen any crypto this winter. Recent commodities and cryptocurrency markets have offered macro hedging on the new omicron variant of Covid-19, the Fed's hawkish outlook and last year's earnings as we fell into our lowest vacation. . Basically, we have seen the involvement of key organizations in the cryptocurrency market. This can be demonstrated by the growing competition from local banks to expand crypto related services. Non-fungible tokens (NFT) and Metaverse add data to further support blockchain activity.

What do you think of the stock market next year? Are there any price estimates for BTC and ETH? What are your hopes for Radar 2022?

We continue to believe that ETH will become Standard Process 1 as ETH transforms into Stake Evidence by mid-2022. The results include attractive tools for investors. All estimates are incorrect, but funny: ETH's annual exchange rate is around 85% to 90%, with ETH rising $ 7,500 and falling $ 2,400.

What do you think of Facebook's enthusiasm for meta-space? What is virtual reality where digital plots of land have been sold for millions of dollars?

I think the metaverse will be the next generation of social media, streaming media, and gaming platform. Total consumer spending over income is about $ 8 trillion. NFTs such as digital devices and installations will become the next meta-space, but will not replace physical devices in the future.

The cryptography law has always been the most important issue in light of recent parliamentary hearings. What do you think lawyers and policymakers should know when running a business?

The rules continue with the cryptocurrency and blockchain markets. Stable financial management is one of the areas that deserves the most benefits. By 2021, the trading volume of public blockchain stability coins will exceed $ 5,000 billion. When dealing with stable coins (e.g. USDC), the market value of stable coins is expected to reach over $ 0.5 trillion by 2022.

What are the key points and events in the crypto space that concern you in 2022?

Spot EFT encryption

The Ethereum mainnet is "integrated" into the beacon chain.

DeFi and Stabilitycoin Asset Complex Policy

Advertising and marketing of security tokens from other industries

Cryptocurrency-based devices

Acquisition and collaboration of crypto companies

Scan QR code with WeChat