Goldman Sachs Offers New Bitcoin Derivatives To Wall Street Investors

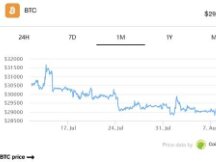

According to Bloomberg News, US banking giant Goldman Sachs has started offering non-redeemable Bitcoin bonds to Wall Street investors. on special days. Importantly, this deal allows Goldman Sachs users to bet on the value of Bitcoin.

Cash contract and you hedge the volatility of the cryptocurrency by purchasing wholesale Bitcoin futures contracts through CME Group. Cumberland DRW crypto asset trading company is a Goldman Sachs business partner.

Gold Mans Sachs Asia Pacific Digital Assets Chairman Max Minton told Bloomberg, “The demand for organizations in this area continues. The ability to work with partners like Cumberland will help us expand our reach. industry. New products will help us. Potential of cryptocurrency to support child development is leading the way.

Those involved in the incident said the partnership with Cumberland indicates the bank is willing to work with outside companies to achieve these goals.

Since the birth of Bitcoin in 2009, Wall Street banks have avoided it, and JPMorgan Chase CEO Jamie Dimon has threatened to kill traders who buy and sell digital assets. Although Dimon's attitude towards crypto products has been aftermarket, the banking industry has long viewed Bitcoin as a toy for terrorists, drug dealers, etc.

However, consumer satisfaction and the rise of the Bitcoin market have led many investors, Morgan Stanley has offered its customers a product from the Bitcoin market and JPMorgan Chase promises similarities.

As BitTweet previously reported, Goldman Sachs announced the resumption of its cryptocurrency business in March of this year and plans to join the cryptocurrency watchdog, providing private capital to the consumer means more deposit. important to the declared value of the cryptocurrency. It is therefore not surprising that Goldman Sachs is moving in this direction.

Justin Chow, Managing Director of Global Marketing, Cumberland DRW, said, "Trade in the market," said Justin Chow, Director of Global Marketing, Cumberland DRW.

However, banks are still wary of the legal issues they face by directly holding Bitcoin. Since derivatives are paid for in cash, assets held by Goldman Sachs do not have to deal with physical Bitcoin. Likewise, trusted firms Morgan Stanley and JPMorgan Chase allow their customers to use the device to track Bitcoin prices while bringing in third parties to buy and hold digital assets.

As long as police are aware of the situation, Goldman Sachs could offer its investments to Bitcoin-based clients using a cryptocurrency exchange or using grayscale Bitcoin trusts.

"The cryptocurrency ecosystem is changing rapidly," Chow said. "I have successfully delivered ETFs. Focus. Now is a good time to enter the space."

Scan QR code with WeChat