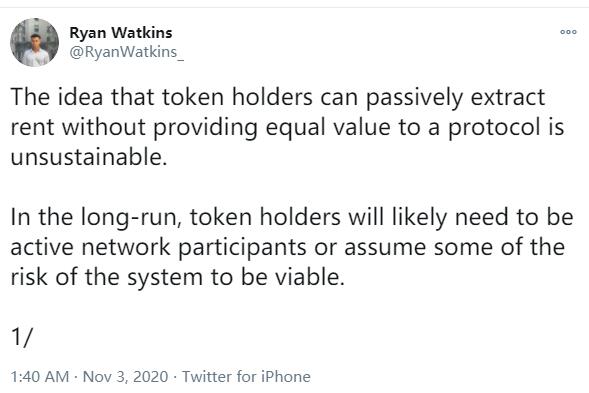

Researcher Messari: Token holders have to stay or risk. The contract must pay the right amount to the stakeholders.

On November 3, Messari analyst Ryan Watkins reported in news tweets that the idea of cutting rent with no equal value to the contract was invalid. In the long run, token holders must either become participants in the transaction or take risks in the system to be usable. There is no risk if the tokens are only paid for the assets used by the owner. Voter involvement is rare because insurers only vote on proposals without getting anything in return. It is the worst financial company that has ever existed. At least the members of the financial institution are still able to have a down payment first. Now that you have capital in your contract, you need to think more about your investment. Now they are all amorphous. Token holders must stay or be at risk, and contracts must be rewarded for stakeholders who offer rewards. The more contracts you have, the better you can meet the interests of different participants.

Weekly News

Cryptocurrencies Market

Flash News

-

01-27 07:53以太坊官推转帖:zkSync稳定币市值30天内增长55%

-

01-27 07:47CZ:坚持基于基本面的投资,时间将站在这一边

-

01-27 07:45Jupiter完成30亿枚JUP销毁,当前价值约32亿美元

-

01-27 07:39Vitalik呼吁加速淘汰Groth16信任设置

-

01-27 07:30金色晨讯|1月27日隔夜重要动态一览

-

01-27 07:17BTC跌破103500美元

-

01-27 07:15AAVE跌破320美元

-

01-27 07:14ORDI跌破20美元

-

01-27 07:11APT跌破8美元

-

01-27 07:02TON跌破5美元

-

01-27 07:02BTC跌破104000美元

-

01-27 06:51CryptoQuant创始人:Memecoin与艺术市场在估值逻辑上类似

-

01-27 06:46SOL跌破250美元

-

01-27 06:44美联储本周维持利率不变的概率为99.5%

-

01-27 06:01THETA跌破2美元

-

01-27 05:16BTC跌破105000美元

-

01-27 04:151.8亿枚USDT从TetherTreasury转移到Bitfinex

-

01-27 03:49目前加密货币总市值为3.762万亿美元,24小时跌幅1.3%

-

01-27 02:46JUP突破1.2美元,24小时涨幅超20%

-

01-27 02:15美国现货比特币ETF链上总持仓价值突破1240亿美元