Appraisal: The DeFi project is an opportunity for the crypto hedge fund business.

10月

07

2020-10-7 00:41

share to

Scan QR code with WeChat

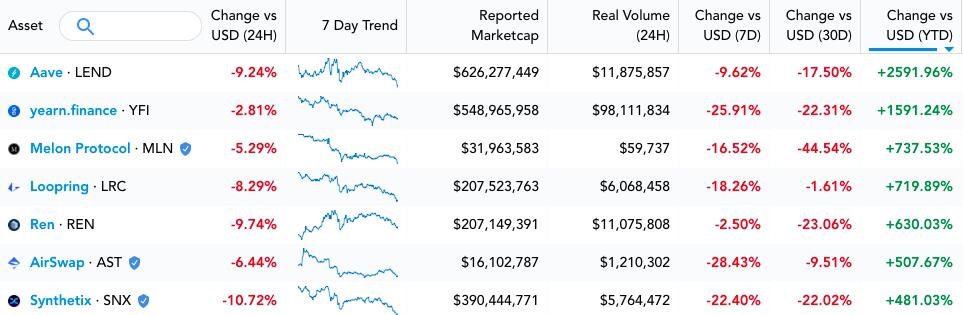

AMBcrypto today announced an article according to which the market for crypto hedging investments can be transformed by investing in a basket of DeFi trades. Due to the high volume of DeFi volume (TVL), the volatility is high, there is no time for financial managers. If the underlying asset is the DeFi project, the average cryptocurrency investment may be better than the underlying asset. According to data from Messari, projects such as Aave, Yearn Finance and the Melon Protocol have annual returns of 507% to 2591%. In the long run, investing in these companies can make the investor more profitable than the investors. Because they are still in the early stages of experimenting with DeFi as an investment tool.

Weekly News

Cryptocurrencies Market

Flash News

-

25 01-27 07:53以太坊官推转帖:zkSync稳定币市值30天内增长55%

-

25 01-27 07:47CZ:坚持基于基本面的投资,时间将站在这一边

-

25 01-27 07:45Jupiter完成30亿枚JUP销毁,当前价值约32亿美元

-

25 01-27 07:39Vitalik呼吁加速淘汰Groth16信任设置

-

25 01-27 07:30金色晨讯|1月27日隔夜重要动态一览

-

25 01-27 07:17BTC跌破103500美元

-

25 01-27 07:15AAVE跌破320美元

-

25 01-27 07:14ORDI跌破20美元

-

25 01-27 07:11APT跌破8美元

-

25 01-27 07:02TON跌破5美元

-

25 01-27 07:02BTC跌破104000美元

-

25 01-27 06:51CryptoQuant创始人:Memecoin与艺术市场在估值逻辑上类似

-

25 01-27 06:46SOL跌破250美元

-

25 01-27 06:44美联储本周维持利率不变的概率为99.5%

-

25 01-27 06:01THETA跌破2美元

-

25 01-27 05:16BTC跌破105000美元

-

25 01-27 04:151.8亿枚USDT从TetherTreasury转移到Bitfinex

-

25 01-27 03:49目前加密货币总市值为3.762万亿美元,24小时跌幅1.3%

-

25 01-27 02:46JUP突破1.2美元,24小时涨幅超20%

-

25 01-27 02:15美国现货比特币ETF链上总持仓价值突破1240亿美元

2updates