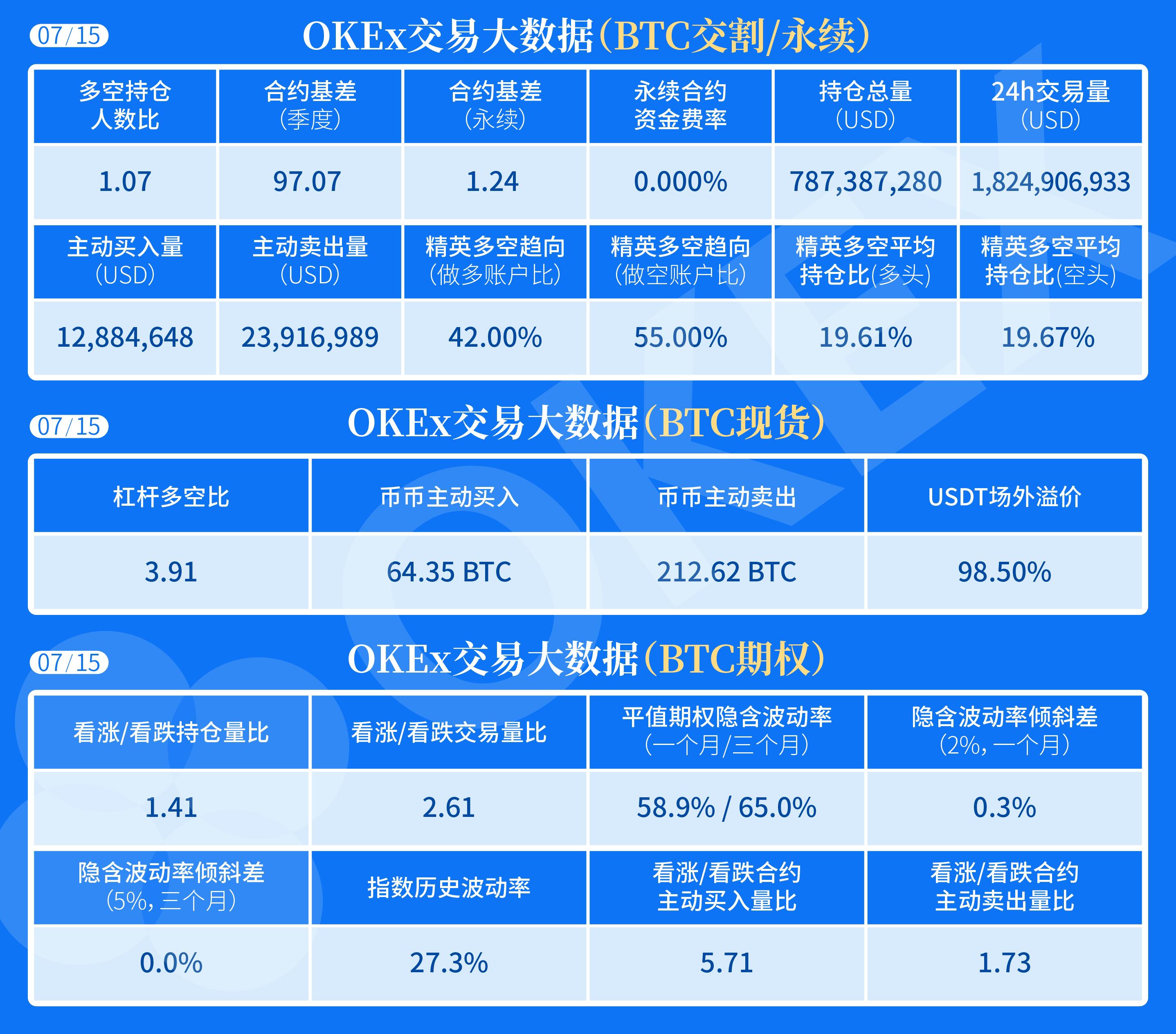

OKEx Big Market Data: The ratio of the long-term position to the short-term position in the BTC contract is 1.07, and the short term in elite stocks is slightly profitable.

Analysts said that as of July 15 at 10:30 a.m., big data from OKEx trading showed that the ratio of long and short positions in the BTC contract was 1.07, and the long and short positions in the market were also equal. . With a quarterly contract of around $100, a permanent financial contract of zero, total shipments and a permanent contract of up to US$800 million, much of the strength of the market cannot be predicted. The contract elite position, the short account ratio 55.00%, the short position ratio 55.00% 19.67% is good, and the short-term elite account is redistributed, pay attention to changes position of the main actors. Under the options contract, the active call/call call rate was 5.71, ongoing frequent customer calls, and market options were relatively good.

Weekly News

Cryptocurrencies Market

Flash News

-

25 01-27 07:53以太坊官推转帖:zkSync稳定币市值30天内增长55%

-

25 01-27 07:47CZ:坚持基于基本面的投资,时间将站在这一边

-

25 01-27 07:45Jupiter完成30亿枚JUP销毁,当前价值约32亿美元

-

25 01-27 07:39Vitalik呼吁加速淘汰Groth16信任设置

-

25 01-27 07:30金色晨讯|1月27日隔夜重要动态一览

-

25 01-27 07:17BTC跌破103500美元

-

25 01-27 07:15AAVE跌破320美元

-

25 01-27 07:14ORDI跌破20美元

-

25 01-27 07:11APT跌破8美元

-

25 01-27 07:02TON跌破5美元

-

25 01-27 07:02BTC跌破104000美元

-

25 01-27 06:51CryptoQuant创始人:Memecoin与艺术市场在估值逻辑上类似

-

25 01-27 06:46SOL跌破250美元

-

25 01-27 06:44美联储本周维持利率不变的概率为99.5%

-

25 01-27 06:01THETA跌破2美元

-

25 01-27 05:16BTC跌破105000美元

-

25 01-27 04:151.8亿枚USDT从TetherTreasury转移到Bitfinex

-

25 01-27 03:49目前加密货币总市值为3.762万亿美元,24小时跌幅1.3%

-

25 01-27 02:46JUP突破1.2美元,24小时涨幅超20%

-

25 01-27 02:15美国现货比特币ETF链上总持仓价值突破1240亿美元