The cryptocurrency has seen more than $500 million in revenue in the past five weeks, with BTC trading volume at its lowest level in six months.

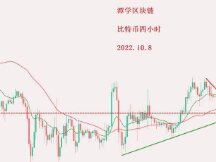

The performance of the cryptocurrency market does not work due to the lower risk of investors. Over the past 24 hours, Bitcoin has been hovering between $41,200 and $42,500, volatility has further reduced, and it's unclear whether the upside or downside is still true, according to Bittui terminal data.

General market sentiment for cryptocurrencies and commodities has historically trended negative, primarily due to the weak Fed signal and uncertainty about the market impact of the exchange change. of omicron. As US Treasury yields rise further, investors appear to be abandoning assets such as commodities and cryptocurrencies in favor of less valuable assets such as cash and index ETFs. Also, with the Fed's rate hike approaching, investors are unsure if they should raise rates further.

Outflow of crypto funds for 5 consecutive weeks

Bearish market sentiment did not subside as investors pulled out of the cryptocurrency for the fifth week in a row. According to a statement from cryptocurrency firm CoinShares,730 Leaks by Crypto Investments in 7 Days to Jan 14$00,000 crypto outflows in the past five weeks totaling over $500 million, the worst outflow since 2018, when Percentage of Assets in Full Control (AuM) is denied.

Bitcoin investment stocks accounted for $53 million of the $73 million outflow last week, with a total turnover of $317 million in the fourth of the last five weeks. Bitcoin under asset management (AuM) hit a three-month low of $35 billion in the week. Ethereum capital markets accounted for the bulk of the equity balance, with $50 million in the past week and $230 million in the past five weeks.

BTC Spot Volume Hits Six-Month Low

The constant fear, as well as the recent recent volatility, can make traders unhappy. According to data.bitcoinity.org, spot bitcoin volume is at its lowest level in six months.

Derivatives traders also err on the side of caution when Bitcoin futures market strength is weak. This means that when the price of BTC starts to rise, volatility will increase as traders who are shorting or betting on falling prices need to liquidate their positions.

Alexander Mamasidikov, co-founder of digital bank MinePlex, said: "Cryptocurrencies have not grown significantly due to lack of market share and top trading activity." So regardless of the macroeconomic headwinds in the market, Bitcoin competition will depend on major investors entering the market at current or lower prices.

RealPlanC, an anonymous crypto analyst on Twitter, noted that Bitcoin is entering the third phase of “thinking for the kiddie roller coaster” (expectations:expectations) and should see a resurgence from the bottom if it sustains above 40. 000 dollars.

Market analysts expect Bitcoin to remain in the narrow range for the near future and extend support at $40,000 and protect at $44,500 until the stock market is wide, higher volatility in Ethereum and other altcoins. It will remain at the same level as Bitcoin. Thursday's US unemployment report could be a force to be reckoned with behind Bitcoin's support or attacks.

Scan QR code with WeChat