Musk predicts a financial crisis in 2022, how should we prepare for the next crisis?

On Dec. 31, 2021, Musk responded to a question from netizens, "It's very hard to predict the macro market. My theory is (business crisis).By spring or summer 2022, or finally by 2023".

Strong winds began to blow over Qingping's comments, and the cryptocurrency market followed the stock market in anticipation of a Fed rate hike, and fell.After last year's catastrophic floods, the economy seems to be coming to an end and the stigma has widened.

Hedging is one of the most important decisions, and as Musk points out, if there is a market crisis after 2022, how will that affect the cryptocurrency market?How can we, as ordinary investors, react in the chaos of the cryptocurrency market?

Bitcoin: “The global currency” in turmoil

On September 15, 2008,It was the straw that broke the camel's back when Lehman Brothers, a big businessman and one of the five biggest banks on Wall Street, announced that the company was bankrupt., the first dominoes of the global financial crisis were devastated, resulting in a financial tsunami that swept through capital markets and bank credit.

Banking business, lots of advertising and people's money are kept in the bank, but if the bank can't be trusted, evenOur financial gains have gone very well and there is no restricted financial reporting (known as "quantitative easing"). So what more could we need?

It was against a background of the unknown that the fire began to appear.

On November 1, 2008, Satoshi Nakamoto released the Bitcoin White Paper. "Peer-to-Peer Electronic Payment System";

On January 4, 2009, Satoshi Nakamoto created the Genesis block and the first gift block was 50 Bitcoin (Now Bitcoin has gone through three halvings, up to 6.25 Bitcoins per block.);

On January 12, 2009, Satoshi Nakamoto launched the world's first Bitcoin market.

Interestingly, Satoshi Nakamoto "imprinted" an amazing phrase while creating the Genesis block.It is time for the Treasurer to decide on a second attempt to resolve the financial crisis.)

It was the latest headline in Britain's Times newspaper that day, detailing the Bank of England's bailout from the aftermath of the 2008 global financial crisis.In fact, in this "Demonstration", we can see Satoshi Nakamoto's point of view as important in the creation of Bitcoin.

By advocating arbitrarily depriving people of wealth through "quantitative easing",Preventing Hyperinflation by Technically Realizing the Ideal of a Supersovereign Global Currency, to ensure that human property is considered sacred.

In 2012, Bitcoin introduced the global potential of a "super-sovereign global currency". At the time, the Cypriot government planned to sacrifice lifeguard benefits to secure an EU bailout.A deposit of EUR 100,000 or more will be used to resolve the debt issue.

This caused great frustration among officers and raised doubts about the security of the bank, and some found that Bitcoin had nothing to do with governance, causing Bitcoin to appear in the world for the first time.

Of course, after more than 10 years of development,Bitcoin today may not be a “Christian world” view.

Users who buy and hold Bitcoin do not use Bitcoin as a currency for payments and transactions.Learn About Bitcoin Based on Market Value Recommendations, similar to "digital gold" - more divisible, portable and Apple Store at a higher price than gold.

However, the recent decline in the value of the Turkish Lira has led to an increase in Bitcoin mining and withdrawal from Bitcoin wallets in Turkey.As in Cyprus in the past, the flames are still burning.

Significant Events in the History of the Cryptocurrency Market Turmoil

However, Bitcoin, which caused a global financial crisis in 2008, has also suffered greatly in the 13 years since its birth.

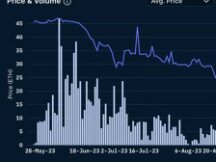

Mirror of History Here we look at the performance of the Bitcoin and Crypto markets in the past, macro issues in the market, and briefly review and rate some of the most well-known markets: “9.4”, “5.19” events " and "3.12".How have the bitcoin and cryptocurrency markets fared in times of macroeconomic turmoil, and what historical norms do they refer to?.

9.4 Revelation

The "9.4 incident" has undoubtedly become a turning point in the industry, and a wave of rampant speculation in China has directly curbed it.

On September 4, 2017, the Central Bank, China Cyberspace Administration, Ministry of Industry and Information Technology, State Administration of Industry and Commerce, China Banking Regulatory Commission , China Securities Regulatory Commission, China Insurance Regulatory Commission of the Seven Ministries abandoned 1C0 financing.

As soon as the announcement was made, the prices of various tokens on the exchange plummeted, with many jobs flagged by 1C0 financiers suffering the most.Each has fallen below the advertised rate, the maximum loss is over 90%, and many jobs have a chance of returning to zero..

Inspired by the history of profits of over 1 million, 10 million and billion, those who entered the cryptocurrency market with 100,000 fantasies rose and became the most dangerous people at the time.

3.12 Brother

From 12:00 p.m. on March 12, 2020 to 12:00 p.m. on March 13, 2020, Bitcoin fell for a week in just 24 hours.$7,600 starts across, first falling to $5,500 and then swinging..

During the recovery, it broke the support until the end, and the bottom fell to $3,600, the total market value evaporated in an instant by $55 billion, and all the networks broke more of 20 billion yuan. There really is a "half price".

There were no eggs in the nest, and immediately the waterfall trade turned the second trade into a "river of blood". The inevitable series of liquidations, particularly in the direction of a full increase in individual and institutional debt, further favors the weakness of liquidity and the sale of companies.

The domino effect caused by the “black swan” style crisis finally killed the bull market and the price of BTC once fell below $3,800, signaling a bear market bottom in 2019.

This catastrophe, enough to document the history of the currency, leads to the frustration of "deleveraging" in a submerged market that explodes in a series of positions.Maximizes almost unstoppable investor panic.

5.19 The

May 19 of last year was an unprecedented "disaster" for those involved in the cryptocurrency industry.

China's renewable energy sector, which once played a key role in mining, including cleaning up and repairing community broadcasters, disappeared in a short time and as a result market fears led to a boom in the beef industry for almost six months. . It is a year of unprecedented evaporation of the market rate.Bitcoin once fell below $30,000, halving immediately after its peak, and the entire cryptocurrency market was bleeding..

How to prepare for the next "Dark War"?

In retrospect, the "September 4 incidents" and "May 19 accidents" are the direction of change from endogenous events in the industry, and the "March 12 losses" are the financial problem caused by the impact macro-environmental. our crisisFaced with turmoil on multiple fronts, the entire crypto industry has come under severe strain..

And all the “turbulence” in the cryptocurrency market turned into a good afterthought.

Hope emerges in the wake of the events of 9/4,Three months later, the cryptocurrency market immediately started to explode., this should also be the first thought of many traders in the crypto industry about the bull market in the crypto industry.

After the "3.12 dip", the cryptocurrency market started with the "Summer of DeFi",It begins with the "Cambrian explosion" which gives the story height and breadth;

More than six months after the fall of May 19Home business encryption has quickly moved to Web3, and home business encryption has entered a new phase.

In short, whatever happens, only those who are prepared and not very careful will enjoy the post-crisis party.

Prior to the "3.12" crash of 2020, Authur Hayes, CEO of crypto derivatives exchange BitMEX, published a blog post predicting the macroeconomic and cryptocurrency crisis."Volatile Longevity and Health".

This is probably the best survival guide in the modern trading industry. What doesn't kill us makes us strong.Therefore, responding to emergencies can be very simple. Secure cash flow, lead a healthy life, and always be prepared for gifts in an emergency..

The crisis will not be time, but only time for those who are prepared.We have always wanted a fast train the same way the crypto industry is growing fast.Long password, short world.

Scan QR code with WeChat