Post-pandemic: inflation in the months and years to come

COVID-19 has caused a severe downturn in the industry, and we do not expect the industry to return to normal. However, the most important goals now are to have full, full-time transmission, operations, and to have the resources needed for better recovery and inclusion. However, uncertainty and market risk are related to future changes.Therefore, inflation is a significant risk that the government takes seriously.

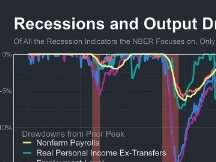

An increase is a rate at which prices change over time and is not just a measure.Increased funding will improve community health. Purchases will decline, especially if wages rise below inflation.However, the constant slowdown in inflation for tax regulators to stimulate the economy, meaning the economy couldn't afford it, gave way to further expansion. In fact, the main issues surrounding current financial risk are that in the decade leading up to the epidemic, inflation was generally lower than the Fed anticipated during the recession. Rising inflation, defined as the personal consumption deflationary index (PCE), similarly declined over the course of the spread, with significant differences between commodities and commodities (see figure below).

Fortunately, while black swan like COVID-19 is rare, it also means the developers have a little story to tell.Historically, the United States has experienced temporary inflation or a major shift in financial resources during contagion. Inflation due to the Spanish Flu of 1918 and the ravages of World War I, the resurgence of defensive spending due to the fighting of WWII and Korea after 1945. However, history cannot serve as a benchmark here for the construction. For example, in 1957 there was contagion with nine months of economic and financial weakness. Even after the global spread ends and the economy recovers, there is no big boom.

However, we expect inflation to rise further in the coming months. It is often caused by three other factors: root causes, chain breaks and conflicts, including demand for services.We expect all three of these to be temporary and disappear as the economy recovers from the spread. Then, the long-term path of inflation will generally return to financial need. The data will grow and revert to the original from a lower background. Then I'll tell you why.

affected cardinality

In the near term, we and other analysts expect to see “positive results” in the annual financial analysis.This phenomenon occurs at the beginning or the first month of development is rarely low or high. Between February and April 2020, when there was a gap in the market, the average rate fell by 0.5% (as measured by the key value of PCE). We expect to see the same fundamental impact on most rates. The decline in this negative rate at the start of the epidemic spread until April 2020 on a low basis.

A year later, we expect the benefits of this base to offset the temporary uptick in year-over-year growth in the coming months due to the slowdown in PCE.No price data for March or April, but assuming monthly inflation is less than 0.2% growth (equivalent to 2% annual inflation) going forward, this is possible depending on the Fed expectations. However, due to these gains, inflation in April and May 2021 reached 2.3%, as measured by fluctuations in the PCE exchange rate from last year. This is not only higher than the recent inflation rate, but also higher than the current inflation rate (1.4% in February of this year). These models will be seen in a variety of cost parameters this spring, including cost estimates and manufacturing costs.

The problem with the fundamentals is that the financials aren't accurate, but in our example the annual budget is still 2.3% accurate. Instead, the root causes affect our understanding of initial short-term inflation, suggesting, for example, that inflation is higher than most analysts expect.Over the next few months, the asymmetric feature of the price data will subside as the root effect of the next few months continues.

Supply chain disruption and chaos

The second potential for inflation comes from the increase in production costs.When the cost of materials needed to build a good product or service has increased (assuming the wood needed to build a house or the electricity needed to build a factory), companies may go too far. far for this price to consumers at a higher price. Economists call this phenomenon the price surge. inflation. Usually, this type of inflation is short lived. Wood or electricity prices rise and then stabilize or fall and do not affect future inflation. This example illustrates the significant difference between the price level and inflation, the latter being the rate at which prices rise and fall.

We have seen product markets affected by contagion.For example, production of industrial products such as automobiles must cease, especially in Asian manufacturing plants, which play an important role in international shipments. As freight logistics become more difficult, so do the costs of transportation and warehousing (land, air, sea). The recent balance of the Suez Canal will exacerbate these problems in the short term. And the demand for some of the products has led to limit the expectations of the industry, such as computer assisted electronics.

Global chains are expected to slow gradually as global markets recover in 2021 and beyond, but in the short term, some companies may be able to cross the temporary chain's added value affecting more consumers.

Requests are prohibited, especially for services

Finally, the prices of many affected services fell as consumer demand fell due to consumer concerns about infection and restrictions on distant coexistence.Such as hotel, restaurant and air travel.

However, as immunization has increased over the past year, the demand for touch services has increased and this may be temporary.Part of the reason for the increased demand could be the savings many families collected during the outbreak and the aid that was provided last year and this year. Americans, for example, may be more demanding for full-fledged restaurants later this year, but will see fewer dining options than before the outbreak. It could keep restaurants alive by raising prices. Despite the limitations of FMCG services, Americans still want to use these services more often or prefer to choose better services (because most families only have vacations).Economists speak of inflation as the result of increased spending in line with demand-driven inflation.

Again, we expect this to be a short-term problem and supply will increase further to meet this stifled demand when markets for services close or fall sharply.

Finances and long-term expectations

The financial outlook is an important factor in determining long-term high prices.For example, if a company wants long-term rates to meet the Fed's 2% inflation target, many of the temporary factors discussed above could affect costs and wages. However, if financial expectations are separated from this target, costs may continue to rise. Rising inflation or "heavy" spirals can cause the average bank to quickly raise interest rates and then slow down the economy, raising interest rates. Economists call this a “hard landing,” so inflationary pressures are a risk that must be carefully watched.

It's important to know that the “hot” market doesn't have to look like real overheating.We hope that the transition from a lean economy to a post-epidemic economy will not only boost nominal inflation growth, but also create a positive impact on the economy. High financial expectations (outlook: continued savings, continued decentralization of benefits, low interest rates when needed). The increase in funds from the lower echelons is welcome. However, financial expectations must be carefully considered to distinguish between actual overheating and short periods of overheating.

The best way to do this is to follow various measures of financial reliability.One example is the amount of income that investors need in the financial markets. Over the next five years (measured over the five years in the chart below), the market will appreciate in line with our expectations of a near-term market. Current investor perceptions of long-term inflation (the 5Y5Y series below represents five years from now) are consistent with recent data and the Fed's strategic plan.

Other reports point to a similar situation. The chart below shows mixed monthly measures that include 22 assessments of long-term financial confidence based on companies and ratings, including households and individuals. expert valuations, including market rates listed above.This mixed measure also shows that financial expectations are higher, but these expectations are within reasonable limits compared to last year.

Sources : CEA, AHN, FULTON (2020), Fed : Inflation Expectation Index

Therefore

The events most likely to occur in the coming months will be driven by the three changes discussed above.Inflation will rise slightly and then decline to a rate below where actual inflation will begin to outpace long-term expectations.This temporary increase in inflation occurs with certain changes after the global epidemic or labor economic changes in American history, such as the post-war crisis. However, we will be looking more closely at real exchange rates and the prospect of rising inflation to anticipate a US exit from the spread and entry into the economy.

Scan QR code with WeChat