OpenSea Raises $ 300 Million to Slowly Kill Users' Airdrop Dreams

OpenSea, the world's largest NFT trading platform, announced on January 4 that it had raised $ 300 million in Round C with an investment value of $ 13.3 billion. Rounds A and B are at 16z, which is not seen in the announcement of financial environment C.

Established in 2017, OpenSea focuses on the unique needs of the NFT industry. Dollar Crypto Industry Unicorn Company.

After OpenSea announced the new funding, users were outraged and people speculated that the platform was not far from IPO plans. While an IPO is a financial option for every unicorn business, OpenSea users expect the platform to advertise its own crypto tokens and access to crypto products rather than coins. stores for sale.

OpenSea's core business is paying consumer market value, which alone will increase the platform's business volume over 600 times by 2021.

According to the user's expectations, users were created in the NFT Meeting was created by web3 era can be returned to the user, and the users can distribute platform. Web2 mortgage companies in the Internet does not have income, walking, traffic, and finally developed resources in the product.

In December of last year, the management of OpenSea's IPO strategy angered users in the community and once led an NFT community to create an OpenDAO organization under the name and donate coins to OpenSea.

As a result of financial environment C, market expectations for the OpenSea IPO have increased. The platform's chief financial officer said he would decide on recommendations from community users, but the reality was lowering the expectations of users waiting for OpenSea to issue tokens.

Schools have traditionally managed the OpenSea Series C budget

In the four years since its inception, OpenSea finalized the new $ 300 million funding. Six months have passed since then and the measure has increased from $ 1.5 billion in Round B last year to $ 13.3 billion.

OpenSea's new financial announcement only features key investors Paradigm and Coatue. The old concept focuses on the crypto industry and Web3 and is a newcomer to the history of OpenSea finance, which the crypto industry calls "new currency".

The latest Coatue, the OpenSea Series B financial party, was behind 16z on financial news at the time. The organization was originally a veteran hedge fund firm founded in 1999. Since then, it has gradually focused on investing in stocks in the open market, including the tech industry, production, news and communications.

Coatue's event capital in 2021 includes Chinese new energy vehicle design "Ziyoujia" and VR interior design platform "Kujiale". Two years ago, Coatue's investment focus began to shift to the blockchain industry and continues to be an entrepreneur in the green smart card and blockchain security service provider "Certik ".

One of OpenSea's largest investors, a16z (Andreessen Horowitz), did not appear in the announcement of the Round C funding announcement. The company is a major player in the OpenSea A and B funding rounds in 2021. It became the world's largest NFT trading platform with a value of $ 1.5 billion after funding round B with $ 2,300 and $ 100 million.

OpenSea financial history

OpenC has taken place more than five times in the past four years, and actors such as actor Ashton Kutcher, who joins the NFT field, as well as organizations such as Blockchain Capital and a16z, and Mark Cuban, owner of the NBA Dallas. Mavericks, generally cryptographic, is the representative of companies related to "New Money". However, Round C funding has always made the organization a major investor.

Whether or not to remove 16z from OpenSea's finances has yet to be decided, but Kotue reappears in Financial Environment C. Remember this during OpenSea's IPO campaigns.

For users of the NFT community, “OpenSea needs an IPO” is a given. Developed by leveraging the NFT industry of service providers, the platform can achieve global disparity through large-scale user engagement. Users can expect to improve in the direction of Web3 and DAO (Decentralized Autonomous Organization) through the proclamation policy, so that free users can enjoy the distribution.

However, the income balance has slowly been broken for users "dreaming of expanding the OpenSea currency". After the announcement of Round C, OpenSea's official Twitter was still inundated with angry users asking if they wanted to donate coins. Others have denied that it is a Web3 product, while others have asked their NFT colleagues not to trade on the platform.

Will OpenSea go to IPO?

The keyword “IPO” was borrowed from OpenSea's new CFO.

On December 6 of last year, OpenSea hired its first Chief Financial Officer (CFO) Brian Roberts (Brian Roberts). In 2014, Roberts became the first CFO of Lyft, the second-largest ridesharing app in the United States, bringing the company a thousands-dollar IPO. Prior to joining Lyft, he held key positions at Microsoft and Walmart.

This was the first major commitment to OpenSea "to grow the business and serve the community", but after Brian Roberts took office there was speculation in the NFT community that this would lead to OpenSea being introduced in stock Exchange.

Guess received a quick response from the media. “It would be foolish not to think of an IPO when a company is growing so rapidly,” Roberts told Bloomberg.

This statement annoys users who have been waiting for OpenSea to release crypto tokens, especially user groups who have paid a high price for the NFT trading platform to help it grow and prosper. , and OpenSea has its own fundraising process. provide the tokens. Over the years, DeFi's fundraising process through startups and project development has become very popular. Some users believe that OpenSea's abandonment of airdrops and IPOs is a betrayal of the community that helps growth.

But Roberts said the company doesn't need more money for itself, but needs money for partners, acquisitions and joint ventures. Following the public outcry, Roberts later tweeted: "The warnings about the OpenSea plans are incorrect. Let's be clear. There is a big difference in thinking about what an IPO is. I would like to finally and actively plan. an IPO adds that the company has no desire to go public, but if it does, it will want to involve the community.

How do community users participate in a corporate IPO? Roberts did not go into details. It is driven by users who cannot wait for OpenSea to give them coins.

On December 24, 2021, the author of NFT "9x9x9" created an OpenDAO project under the name DAO and released the correct SOS token for users of OpenSea, the ultimate game in the size of 2021. The token drop and meme hype are crypto SOS referred to. as a secondary activity of assets.

SOS but two weeks ago

SOS has been on the market for two weeks, from the start of $ 0.0000014 to the peak of $ 0.0000011 with a maximum increase of 685% and now the distance to the top is halved. Regardless of what was scrapped, it could be a show of force for users, like an outcry over OpenSea's IPO plan. This shows the real expectations of users for the special commercial encryption platform.

Now that OpenSea has completed the C investment, it looks like it won't be the end of the budget.

When the first sharing of the encryption industry, the business tool is encrypted trading platforms have set to US stock at April last year. Since 2013 through 17 rounds of financial by 2020, $ 547.3 million is full of $ 547.3 million, and finally to IPO. In comparison, activate the money and the process moves faster.

Interestingly, both platforms have a16z in terms of investment. The company was carrying around $ 25 million in Coinbase. In OpenSea's A and B funds, the organization's total revenue reached $ 123 million. It also shows that capital is more pragmatic and volatile than the NFT industry.

In Opensa CFO Roberts, "OpenSea is not ready for the first public comment." The platform will not be an IPO, but it is not excluded excellent posts. He also bury women for the community. "This will not be able to avoid the end discourage that waits for opening calls.

OpenSea's capacities and competitiveness

After the emergence of the NFT market in 2021, the application of heterogeneous tokens is still in the infancy of the market, the chain industry is not rich enough, and the situation and modes of application still to be developed. Innovative and interesting.

According to data from third-party data provider OKLink, worldwide revenue from NFT-related products stood at $ 183 million as of Jan. 4, with an inventory still ongoing. followed. As of January 5, the market cap of CoinGecko-linked NFT cryptocurrency operations was $ 48.5 billion, which is only 2% of the total market cap of cryptocurrency assets.

More Businesses is also a large place to enter encrypted art, and yuan, yuan, the ability of opening an extension of the size of market.

There are currently nine NFT product categories available for the OpenSea business: Art, Print, Brands, Music, Video, Sports, Business Cards, Consumer Electronics and Virtual Worlds. According to the platform that announced its C tour de table on January 4, the market share of NFT's OpenC products was $ 255.8 million, compared to nearly $ 322 million set at the end of August last year.

The OpenSea NFT team is négociable

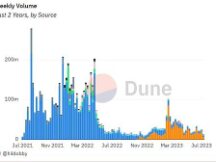

In December of last year, OpenC's monthly revenue was $ 3.24 billion, down 5.3% from August's high of $ 3.42 billion. In just 4 days from 2022, the platform's market volume has exceeded USD 700 million. Some news outlets have predicted that OpenSea's monthly launch will hit an all-time high in the first month of the new year.

Surface data performance shows that while OpenSea has apparently not affected its move to a larger size, it is now at a crossroads depending on its readiness for the Web 3 era or Conquest. from the Internet. What are the advantages of switching from Web2 to Web3?

Whether OpenSea is a Web2 product or a Web3 application is not essential in deciding whether it is an IPO or not. After conception, the platform has always been designed to package products in order to provide services to users who prefer NFT, which is one of the applications of Web3 responsibility.

According to the concept of Web3, the Internet of the future should be a network where users manage their information and users control the value of their information. Blockchain is one way to make this vision a reality. It allows users and traders to access and use the network. Wallets allow people to manage their digital and business assets, and manage the creation, exchange, and other information locked in chains that cannot be compromised. Servers and data are stored synchronously through the node domain of the distribution network.

In this way, OpenSea is not good enough for Web3 and is not designed by the chain, but the NFT products are sold by it by the chain. These NFT trading platforms are non-fungible in the long term, DeFi is an example of this. Daily trading of the decentralized trading app Uniswap has passed the core Coinbase trading platform several times.

Decentralized NFT trading platforms are available, Mintable is one of OpenSea's competitors, and although the packaging industry is not yet strong, it is managed by a decentralized stand-alone DAO which is close to the platform. market in the era of the Web3. . Especially when there is no hope of posting coins to OpenSea, crypto users will start to think of a platform that is more engaging and willing to listen to what users want.

Scan QR code with WeChat