Can high interest rates and stable farm incomes beat inflation?

Stable financial management is a hot topic in American regimes. It is an important part of the crypto ecosystem by exchanging different tokens more smoothly. When the cryptocurrency market was in its infancy, people had to use the BTC pair with other altcoins. Stablecoins change the rules of the game and give others a choice. Since then, the market has changed.

Since regulators have focused on stable currencies such as the USDC and USDT, the future of these stable currencies remains uncertain. This is why we are seeing an increase in stable results like Terra and Frax. They are algorithmic and decentralized. Although this is the stable USD coin backed by algorithms and robots, the structure of farm income has changed with demand.

High Interest Stabilitécoin Farm Income

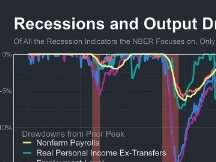

As inflation rises, people have to find ways to overcome inflation. Currently, the average annual recovery of the S&P 500 is 7%, which is very good under normal circumstances. However, when the price reaches 6.8%, more benefits are consumed. Inflation concerns have forced high-risk individuals to pull out of their traditional assets. People are turning to crypto which can be seen as a very risky thing that people see more than just gambling.

However, stablecoins have changed the concept of “high risk, reward” and can generate positive climate gains. A stable ROI of around 8% is currently the norm in the cryptocurrency industry, and of course, the potential for DeFi connectivity increases the likelihood of that recovery.

Take the Anchor Protocol, for example, a cost reduction process for the Terra ecosystem. Terra is an algorithmic stability coin that represents risk. Algorithmic Stability Coins do not collect bonuses like regular bonds. Instead, it relies on algorithms to mold and burn equipment, as the industry demands security. Anchor is presented as a SaaS contract. A contract that allows users to benefit from a stable 20% exchange rate.

Ecosystem participants deposit a portion of USTs on the financial markets as depositors. He then lends money to the lender, earning interest. It then distributes the interest to depositors. Basically it's like banks do, but instead of dividing the income by time, they keep it to themselves. When a user deposits UST in Anchor Currency Trading, they receive proof of exchange of UST (Anchor Terra) for the deposit. When the user earns more money, he / she will receive that income in AUST, which the user can redeem for UST, and the UST fee is still $ 1.

Lenders outside of the cash register must register with Anchor for free to participate. They can use other assets to negotiate and close those assets to start a loan business. However, lenders should keep track of their loan rates (LTV) for example to avoid any credit failure.

Where is the danger?

"There is no free lunch in the world." Of course, there are risks. UST is a stable algorithmic gain. This means that there is a risk of runoff if the nail falls out. In the fall of May 2021, when the overall cryptocurrency market fell, we saw the UST drop from US $ 1 to US $ 0.85 as people sold everything with stablecoins in the fear. It provides an incredible means of arbitration.

The supervisor took advantage of this moment. Because UST security rates are also dependent on LUNA, LUNA crashing is a serious problem for UST. LUNA was down 80% in May.

Terraform Labs, the team behind Terra, took steps to improve the algorithm responsible for logging in after this crash. Tested again in September and found to be very solid. In this case, it was the most stable coin during the period of volatility in September after Bitcoin transactions in El Salvador.

However, there are many ways to reduce this risk. Buy decentralized insurance through Unslash. If UST loses connection and receives payment, the user will be able to purchase insurance. This will reduce your income by 2.5%. However, it is important and in risk management maintains the recovery at 17%.

Considering the frequent DeFi hacking attacks in the industry, it only makes sense that you are more concerned about the failure of smart contracts. Users can purchase a smart card from Nexus Mutual. It costs 2.6% more revenue. Even if something goes wrong, users can still hold a 14.4% return and keep risk stable.

More and more traders are leaving the market and turning to stable markets. With the incredible number of repatriations and rapid inflation that banks offer, no one can blame them. Do you understand why banks are threatened today? DeFi is a financial process hunter and is just getting started.

Scan QR code with WeChat