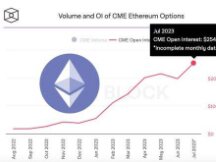

CME group issues future aggregation of micro-Ethereum and ETH stocks at the $ 4,000 level.

MicroEthereum Futures became the newest crypto derivative of the CME Exchange, and other products include MicroBitcoin Futures, Bitcoin Futures, Bitcoin Futures Options, and Ethereum Futures.

CME Group, a leading derivatives company, has expanded its cryptocurrency products, including micro-Ethereum futures.

In a statement released on Monday, the CME Group announced the announcement of a 0.1 ETH micro-Ethereum (ETH) futures contract offering other ETH risk products to businesses and clients. The micro ETH cash-out derivative is traded under the Globex code METZ1 and is added to trade cryptocurrency transactions, including micro Bitcoin futures (BTC), Bitcoin futures, Bitcoin futures and Future Ethereum.

"The latest member of the CME group's cryptocurrency suite has arrived. You may trade micro-Ethereum in the future."

-Groupe CME (@CMEGroup) December 6, 2021

Tim McCourt, Global Head of Other Products of the CME Group, said: “Genesis Global, one of the CME Group's cryptocurrency derivatives liquidity providers, has announced that it has partnered with the company to XBTO cryptocurrency investment to sign a contract for the micro ETH product market in the future.

“The future micro ETH contract addresses the need for simpler and more precise triangular hedging,” said Joshua Lim, director of derivatives at Genesis.

The announcement comes after the prices of several cryptocurrencies, including ETH and BTC, fell for the week. According to data from Cointelegraph Markets Pro, the price of ETH has fallen more than 15% since reaching an all-time high of $ 4,785 on November 8. The price of the second largest cryptocurrency by market cap at time of press was $ 4,016, down more than 13% in the past seven days.

The CME Group announced its first Bitcoin futures contract during the bull market in December 2017. Micro-Bitcoin futures trading began in May. The company said more than 3.3 million contracts were traded as of Thursday.

Scan QR code with WeChat