Virtual currency “mines” have no place in China.

The “mining” of virtual currency is not profitable for industrial and technological development, and its illegal status has also become a reality in the justice system.

The slowdown in “energy mines” poses a major threat to the acceleration of green and low-carbon growth in our country. In order to remove all land for living from virtual resources in China, it is necessary to give yourself no excuses and all the services to establish a relationship within the community and create a long-term governance crisis. Whether it is the 'me' of virtual currency or the 'marketplace', China has no place to stand.

As our country continues to tighten its controls on virtual currencies, the illegality of "only" Bitcoin has become more apparent in court proceedings.

Recently, Beijing Chaoyang Court and Dongcheng Court presented the status of the Bitcoin mining contract dispute in their legal status. The decisions were the same, both determining that the contract was void and the outcome was at their own risk. The first is "causing harm to people" and the last is "conflict in public culture". Now, many courts have ruled that Bitcoin and other business transactions are invalid. These decisions show that our country is ready to deal with the cryptocurrency crisis in accordance with the rule of law and also provides a good example of handling similar situations in the future.

Since last year, under the influence of various factors such as global financial confidence, Bitcoin and other cryptocurrencies, which have been presented as a target of “hedging” by the capital markets through the world, have led to a new era of "commercial harassment". Prices go up and down. As virtual reality in the “business” attitude of the house deepens, some experts have said that “just everyone” has arrived.

The so-called "mining" is simply the process of counting virtual goods from a high-speed computer, ie the "mining machine". Compared to high-risk, high-volatility cryptocurrency trading, virtual currency "mining" appears to be profitable, but in fact, it remains in the realm of capital investment and has its downsides: energy consumption. high and high carbon footprint. casual. According to research data published by a Chinese researcher in the field of Nature Communications in April this year, the annual consumption of the Chinese Bitcoin blockchain will reach 296.59 TWh in 2024 without political impact. (1 TWh is equivalent to 1 billion kWh of electricity), generating 130.5 million tonnes of carbon emissions.

Virtual currency “mining” is not profitable for industrial and technological development, and the use of “mining” energy is declining as a major threat to green and low-carbon growth in our country. As the Chaoyang court pointed out, this "mining" activity is not in line with our country's goal of achieving carbon and carbon neutrality, and the virtual benefits created and business continuity, the risk of business failure and the risk of investment risk are significant. , and is of public interest

In May of this year, the State Security and Reform Commission of the State Council formed the basis for the demolition of bitcoin mining and trading, and ruled that the pressure in favor of personal change was dangerous for the relationship. Since then, the National Development and Reform Commission, the Ministry of Industry and Information Technology and other departments have banned the creation of virtual "mining" projects under a single name, and watersheds “Miners” were re-registered because the activity was suspended. . . ; At the same time, the diagnosis and treatment of "mining" are being stepped up to speed up production. The project will end in refinement. Many institutions, including mid-sized banks, have made it clear that profitable businesses such as virtual currency exchanges are financially corrupt. Many areas have also been upgraded to clean and tune electrical applications to "critical" and have moved from the dark past to mining and IP surveillance.

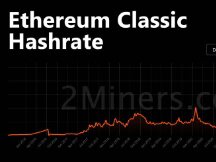

Under strict supervision, the calculation of the strength of virtual profits in the "mining" house fell sharply. Major “mining” is totally prohibited, but certain “only” practices are still very widespread. One hundred thousand walker is half 90. In order to eliminate all virtual virtual goods in China, we must render all services desperate, build relationships, advantages and disadvantages of constant surveillance, and violations of the law. And management won't give up in a way. Whether it is the 'me' of virtual currency or the 'marketplace', China has no place to stand.

Scan QR code with WeChat