Bitcoin retreated after hitting new highs and the pound fell sharply.

On November 10, the US dollar index rose 1% to 94.90, its highest level since July 2020. The US CPI in October marked its biggest gain since 1990, speculates that the Fed could raise rates more quickly.

The US economy, which was at its slowest pace in a month, boosted US incomes, and rising inflation triggered a financial crisis, causing the Nasdaq 100 index to recession. high-tech products are considered commercial products. generally vulnerable to inflation. Profits on two-year US Treasury bonds rose, and the US CPI posted its biggest gain since 1990 in October. Rising prices prompted the Fed to lower or raise interest rates earlier and increase commodity and commodity risks.

The October CPI rose 6.2% year-on-year, reaching an average of 5.9%. Treasury Secretary Yellen said on Tuesday that the Fed would not allow the 1970s to repeat itself, reiterating that inflation will not continue into the next year, but traders fear the new data is enough to get the Fed to increase rates. Interest rates began in June 2022. The US dollar rose on Wednesday, reaching its highest level since July 2020, as US consumer spending hit its highest level since 1990.

The dollar closed at 94.88 to 0.96%, the highest in 15 months, at 94.90. When the Fed reiterated its assumption last week that the rise in inflation rates would be short-lived, many traders said that a longer-than-expected rate hike would force the Fed to raise rates. According to the US Department of Labor, the Consumer Price Index (CPI) rose 0.9% in October, up 0.4% from the previous month, up 6.2% from the previous month at the same time last year. The pound fell 1.12% against the US dollar to $ 1.3405 late in trading after hitting a low Friday of $ 1.3425. GBPUSD

[Technical Commentary]: Cycle D1 shows that the price is limited by the lower slope and massive market sales. Traders can think of ways to stay near the closed area. for

[Trading Strategy]: Current trading patterns indicate a short term uptrend. Traders are advised to consider shorting near 1.3470, Stop Loss near 1.3550, and Stop Loss near 1.3300. The above reviews are for the opinion of industry analysts only and are for informational purposes only. BTCUSD

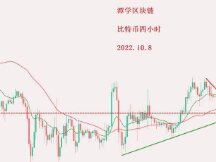

[Technical Commentary]: The H4 cycle shows prices rising then falling and short-term market patterns. Traders may consider paying for time spent near the protected area. for

[Trading Strategy]: The current trading pattern indicates a short term uptrend, so traders are advised to consider a short sell near 66350, Stop Loss around 68000 and Stop Loss around 63000. The above opinions are the opinion of the industry expert only. and are for informational purposes only.

Scan QR code with WeChat