Ray Dario, the chaplain of financial finance: the stock market in an age of inflation

The actions of billionaire Ray Dario, a leading figure in the venture capital industry, have had a huge impact on Wall Street and the global investment community. How has Dario's investment strategy changed in the current inflation environment? Earlier this week, he announced his investment strategy in an interview with Yahoo Finance.

"money is wasted"

Dario believes that while many investors think cash makes more sense in an investment, inflation can generate more fiat money than most people would expect. .

“I mean cash. 'Cash is waste' is considered by most investors to be the best investment, but it is also the worst investment because it loses investment.

What I mean to investors is that you should look at your income or assets at face value, say, the money you have, not inflation.

Like cash this year, you will lose 4% or 5% due to inflation. So be careful. I think it will be the worst investment ever. "

Invest in "alternative currencies"

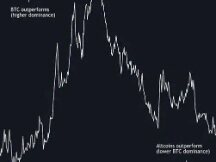

He invests in Bitcoin and Ethereum as an alternative to cash, as the value of cash continues to decline due to inflation, and he calls crypto assets the "other currency" in the age of liquidity devaluation.

When asked more about the crypto wallet, Dario said, "I'm not going to tell the truth about Bitcoin. I also have a little Ethereum, but not a lot. Other perks."

And what I'm happy to see is that (Ethereum) still exists, has never been stolen, and adopted more children than it did two years ago. "

A different portfolio is important.

Dario believes cryptocurrencies help differentiate investor data and can be used to hedge against inflation.

“It is important to broaden your investment portfolio. The average value of these wealth classes is better than cash because we are happy to learn treasures.

Also, when the market is going down, the contract shifts to each other because the money is more profitable than the commodity. So ownership is different - crypto assets are only part of it. "

Ray Dariointroduction

Ray Dalio, 72, was born in New York, Italy, and is the world-renowned U.S. CFO, financier, and founder and CEO of Bridgewater Fund, the world's largest fundraiser.

Dalio has been recognized as a leading manufacturer in the financial services industry and has supported many models of investing in modern applications, such as equity risk, alpha investing, and international business management. Former Fed Chairman Paul Volcker even went so far as to say that Dario's review of the Bridgewater Fund's financial results is more reliable than that of the Fed. The "New Yorker" called Datta "the thinker of the big picture".

Two years after earning an MBA from Harvard Business School, Dario acquired Bridgewater in 1975 in a two-bedroom apartment in New York City. very good explosion. Since then, the company has engaged with major clients including the World Bank and Eastman Kodak Pensions.

The Bridgewater Fund became the world's largest hedge fund in 2005. In 2011, it overtook Soros' quantum fund, the financial alligator, to become the world's largest hedge fund. In 2011 and 2012, he was named one of Bloomberg's 50 Most Powerful People, and in 2012, he was named one of the 100 Most Powerful People in the World by Bloomberg.Time magazine. In April 2021, Dalio was ranked 88th on Forbes' richest in the world list with a fortune of $ 20.3 billion.

Dalio is China's target and friend. For example, in October 2020, he warned the West not to ignore China's rise to power, believing that China would continue to become a global superpower. He said China has achieved a "one-way street," including the operation of the industry, despite the spread of COVID-19. He believes China is now on par with the United States in the use of technology and could take the lead over the next five years. From an investment perspective, he said investing in China is a good thing. He said that China's key economic sectors are strong and the value of property is also very attractive.

Dalio was passionate about financial aid and in April 2011, along with his wife, he joined Bill Gates and Warren Buffett in a donation, pledging to donate more than half of his fortune in his life to charity. He has donated over $ 5 billion to the Dario Foundation, which has donated over $ 1 billion to organizations.

Dalio published "Rules: Life and Work", a book on business management and investing in 2017. This book was listed in the "New York Times". Best product of the year and named "The Gospel of Total Transparency".

Scan QR code with WeChat