How to measure the market value of the blockchain company after Zhao Changpeng became "the rich man"?

In fact, Binance is already the world's largest cryptocurrency exchange. In the crypto arena, on the other hand, the global cryptocurrency market value has increased more than fivefold this year, reaching $ 3 trillion in November. Moreover, the value of the exchanges has increased further due to the rapid increase in the global cryptocurrency capital.

The cryptocurrency hearings in the United States House of Representatives last week sent positive signals to the crypto industry, and many lawmakers have expressed support for the industry. At the same time, more and more crypto investors are on the rich list.

According to information published by the financial newspaper Weibo on November 30, Binance founder and CEO Changpeng Zhao has become China's richest man with a fortune of $ 90 billion and is among the ten richest people. of the world. Once this news is known, it creates a buzz in the industry and causes controversy.

In fact, Binance is already the world's largest cryptocurrency exchange. In the crypto arena, on the other hand, the global cryptocurrency market value has increased more than fivefold this year, reaching $ 3 trillion in November. Moreover, the value of the exchanges has increased further due to the rapid increase in the global cryptocurrency capital.

How to measure the market value of exchanges with the rise of cryptocurrencies? Is Zhao Changpeng's name "Richest Man in China" worthy of the name?

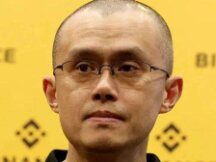

Changpeng Zhao et Binance

Binance is a cryptocurrency exchange founded in 2017 and is now the largest cryptocurrency exchange in the world.

The creator is Zhao Changpeng, a cryptocurrency expert with over 4 million Twitter followers. He is a Chinese-Canadian born in Jiangsu Province in 1977 and moved to Vancouver with his family in the 1980s.

Prior to finding Binance, he worked for several companies in Tokyo, New York and London, including developing the future software business at Bloomberg.

Changpeng Zhao once said that the first time he heard about Bitcoin was at the Shanghai Games in 2013. In 2014, he sold his apartment in Shanghai and traded it for Bitcoin, then went to work. for several cryptocurrency startups.

In 2017, he joined Binance in Shanghai with a working group. However, Binance, which was restructured at the time, came under strict scrutiny, and on September 4, the central bank and its seven subsidiaries were jointly announced: "Notice on token disclosure and financial protection ”, as well as all requested advertising and funding. . Stop immediately.

Affected by the stress of ICOs, home virtual currency exchanges are either shut down or shipped overseas. Binance also announced that it will move its servers and base to Japan and no longer work for users in major China.

However, six months after its inception, Binance has grown into one of the largest cryptocurrency trading platforms by volume. At the time, the total market share managed by the platform was around $ 500 million, which returned 0.1% in value. As of December 2017, Binance had over 2 million users and its strong presence continues into the second year.

Additionally, providing multilingual services at the start of its production also helped Binance manage overseas markets. “More international is the first thing we do,” Changpeng Zhao said in a recent interview with Forbes. Binance promoted 4 out of 9 languages in a single month of broadcast, and now 31 languages have been added to its interface, setting it apart from its existing competitors in fewer words.

At the same time, Binance has users all over the world. You can see Binance users from non-financially developed countries such as Africa, South America, and the Middle East to Europe and the United States.

Binance's platform token, BNB, was also a reason for its rapid growth in the short term. One of the main responsibilities of BNB is to eliminate exchange rates, when Binance started out, they paid 0.1% for unregulated BNB exchanges and reduced the exchange rate for BNB changes. .

For use, Coinbase charges a 0.5% fee in the cryptocurrency market. Binance's lower prices have attracted more consumers and BNB prices continue to rise.

“Binance received its first user launch in a token sale and this community of BNB members has made a significant contribution to the development of the platform.” Binance co-founder He Yi told Forbes in 2018, "Only with BNB, we know that is the secret to Binance's development."

Currently, BNB is the third largest cryptocurrency after Bitcoin and Ethereum.

Are “the richest Chinese people” on the list?

On November 30, Tsai Jingji announced on Weibo that "Changpeng Zhao, owner of the richest man, is worth $ 90 billion." I can only tell. Part of the two lists were linked to select "Forbes" 2021 World Financial Names and 2021 Mainland Company Names.

The list published by Caijing Magazine is not determined by its own design, but the Wall Street Journal told Binance insiders that "if Binance goes public, it will be economically viable. $ 300 billion trade," and in Forbes , the owner of Zhao, accounts for about 30 percent of the company's product portfolio. % and value of $ 90 billion.

On the 2021 "Forbes" list of the richest people in the world, Changpeng Zhao was ranked 1664 with a net worth of $ 1.9 billion.

It should be noted that Changpeng Zhao never disclosed his stake in Binance. However, in a recent interview with the news agency, Zhao said his assets mostly consist of Bitcoin and BNB which he bought and held in 2014.

He says BNB is the bulk of his debt. He also said, "I am a key member of Binance if I ever want to know the value of my stakes."

Currently, Binance does not list or directly disclose the results to the company. However, on October 18, Binance announced that it had broken 1.34 million BNBs worth $ 640 million in the third quarter of this year, generating profits of $ 3.2 billion, or roughly $ 20.3 billion. of RMB, during the quarter. First, in Binance's white paper, he stated that 20% of monthly income should be used to redeem BNB (after converting to burn).

The above quarterly profit estimates are yet to be confirmed. However, it is not easy to see that the benefits of cryptocurrency exchange are significant. When asked if he is one of the richest people in the world at the Bloomberg Innovation Economic Forum 2021 last month, Changpeng Zhao said, "He doesn't care about wealth." He says he will feed 99% of his fortune. richness.

Although the value of a cryptocurrency exchange can be very good, it is not easy to estimate the market value of the exchange that provides cryptocurrency services.

Liquidity in the crypto sector

In September 2018, Bitmain submitted an investment announcement to the Hong Kong Stock Exchange, and a month ago CoinDesk estimated that Bitmain could raise up to $ 18 billion in cash, including the market value of 40 to 50. billions of dollars. indicates yes. However, the request was not accepted even after the six-month validity period. At the same time, applications for registration in the Hong Kong market for Canaan Technology and Yibang International were rejected.

In January 2019, Li Xiaojia, then Chairman of the Hong Kong Stock Exchange, responded to the refusal of IPOs from our company “Hong Kong Stock IPO” at the World Economic Forum in Davos. "In the event of an IPO, the main principle of the Hong Kong Stock Exchange is to fix the exchange rate," "None of our mining drilling companies comply with this policy."

Thinking back to Bitmain's announcement sent to the Hong Kong Stock Exchange, one can see that the market structure of the traditional financial system is difficult to adjust to estimate the market value of crypto industry exchanges. For example, at the time, Bitmain transported value-based cryptocurrencies and viewed them as non-core assets rather than standard assets.

At the same time, the report states that some of Bitmain's significant risks include the possibility that cryptocurrencies may not be able to maintain their long-term value, the potential for volatility in the cryptocurrency market and management. of the risks associated with extracting, holding, using or modifying. .

Currently, Canaan Technology and Yibang International have successfully landed on the Nasdaq. One of the main developments in the cryptocurrency space this year is that Coinbase, the largest cryptocurrency exchange in the United States, is listed on the NASDAQ. What is evident is that the company has chosen the direct listing over the IPO, and the starting price is affected by the market on the first business day.

However, the economic and financial problems of companies in the cryptocurrency field are close to the market value of the cryptocurrency, so the exchange rate of the cryptocurrency is not stable.

Scott Duke Kominers, an expert from Harvard Business School, said in an interview with the Blockchain Daily reporter:Compared to NFTs, cryptocurrencies need to be widely accepted before they can be of value.

According to data from CoinMarketCap, there are now over 8,000 cryptocurrencies in circulation. Opinions from many insiders suggest that different cryptocurrencies will not have the same value.

Deng Jianpeng, professor at the Central University of Finance and Economics, told reporters that Bitcoin and Ethereum have the highest market value: easy to pay in some countries; The end is the end. Its value is given by the growth of its users, the differentiated Ethereum applications and its stable presence. "

At the same time, there is a certain correlation between the income of cryptocurrencies and their market value. In addition, Deng Jianpeng said that there is often a relationship between market value and income. However, there may be exceptions, such as high production control and low water availability.

He added that a strong capacity means the products are easy and convenient, and there are many holders and buyers, which may lead to additional costs.

Liu Changyong, expert at the Whale Platform think tank and director of the Blockchain Economic Research Center at Chongqing Technology and Business University, shared the same thoughts.Market value and income are not affected at all, and the relationship between decentralized assets and median assets is different. The relationship between market value and business income and income from solid assets are mutually supportive.

He said, “Centralized assets are not essential and the facility can be successful in achieving high business success with low revenues, breaking down large investments with low operating costs, or even generating business costs and revenues. important.

Financial newspaper Weibo Night confirmed that China's richest man replaced owner Zhao Changpeng, Zhao appeared on Twitter rankings, claiming that "the measure of incompetence does not make sense."

In the field of cryptocurrencies, not only cryptocurrencies but also the liquidity of exchanges are of equal importance. According to the latest data from CoinMarketCap, Binance Average Revenue (Avg.Liquidity) is the first of all exchanges, followed by FTX.US and FTX.

However, the market value of an exchange is not estimated by one. Liu Changyong told reporters on "Blockchain Daily", "Revenue, market share, large customers and distribution, business sentiment, environmental policy, efficiency, market value and platform coin flow." Genre and more. "

Scan QR code with WeChat