DAPP interfaces like dydx caused by Amazon cloud services.

On December 8, the dYdX derivatives contract was terminated for commercial services, and this phenomenon is caused by the collapse of Amazon Cloud (AWS), the official said.

Now, dYdX can place orders in "return only" mode. An order sent before the deadline is "canceled or completed," the official said.

According to research data, the AWS server problem focused on the three-is-1 zone that AWS held in Virginia, which is still the largest data center, and games such as Disney, PUBG, and LOL. were discontinued after the collapse of the service. .

Although no research is currently underway, the market expectations for AWS were too high as the main platform was shut down for a long time due to past failures in AWS Japan. decentralized use.

In fact, if we dig a little deeper, we can see that the problem of distributing the data in the media has happened because the distribution application is in full swing when there is a dYdX downtime.

01 Isn't AWS secure or centralized?

Before diagnosing a dYdX service crash itself, it is important to understand whether the issue is a security issue due to a downtime due to downtime in AWS, or that all of the storage methods for data on the media is not secure.

There are now two major cloud computing companies in the world: Azure, Microsoft's cloud computing service, and Amazon's AWS.

The name of AWS is Amazon Web Services, which is a cloud computing platform developed by Amazon that provides a variety of remote services. From a global business perspective, the joint venture between Microsoft, Google, IBM and Alibaba Cloud on cloud providers is different from AWS from Amazon.

In the cloud industry, AWS has nearly 50% of the infrastructure as a service (Iaas) market share, ahead of the rest. AWS has also emerged as a leader in the cloud industry with its broad product portfolio, and other similar cloud service companies are gaining ground like Amazon.

The Amazon AWS cloud service helps employees reduce hardware costs. The parties don't need to buy the servers, they just need to get the dedicated servers in the network for metering, storage and database services when they need storage and data services. counting.

Companies just need the tools to make the various investments. Therefore, AWS services only take a few minutes to get your servers up and running.

The cloud computing represented by AWS has its advantages, but also its disadvantages. AWS provides a Spot Instance service. There are times when there is no capacity. Consumers can buy without paying full price, but they are selling at a bid price. Bid on free resources on AWS.

This form allows users to use AWS resources at a reduced rate of one or two times. However, once other users bet more, resources are stolen all the time, so it is not stable and there is a need to think about how to move services faster.

After learning about AWS, let's go back to dYdX files. After AWS, the largest third-party service provider in the AWS East-1 region, shut down the service, operation of dYdX was immediately discontinued, and only dYdX previously, which did not ship with the route ready. for immediate service, may stop.

As we know, the incidence of cloud computing services in the region is very low. has a big impact, but depending on the legacy platform, the data services. 7 * 24 hours of continuous operation, failure will not only increase investor confidence, but also cost hundreds of millions of dollars in losses.

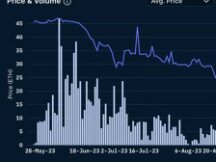

dYdX had the highest daily trading volume of $ 18.6 billion, causing a loss of up to $ 775 million for every hour of stopping trading.

Therefore, the root cause of this problem is not only the instability of AWS, but the fact that the form of cloud computing is not suitable for large DEXs such as dYdX. In other words, we cannot guarantee that all counts and data stored for 7 * 24 hours are not compatible with DEX.

02 Conflict of centralization of application distribution

There is an industry statement that "People can never solve the problem of decentralization. People have to be in the middle. Decentralization is impossible, but it is only limited to the level of demand. And never reached the level of the system. "

I don't want to criticize this argument too much, but now the development of blockchain, as mentioned in the debate, the fact "does not achieve decentralization at the system level", because this blockchain technology itself has limitations.

In the impossible triangle of blockchain, three characteristics of performance, security and decentralization form a triangular product, and if you increase the ratio of one of them, the ratio of the other two characteristics will decrease.

Although the current blockchain technology has led to more than 10 years of successful development and its performance has improved and become more and more, it has not yet reached the level of includes the strength of the existing Internet , which relies on security and the distribution structure. .

And using the capital layer of the “middle” chain is undoubtedly expensive. So while most DEXs, blockchain games, and DEFI projects are running, the most common way is to do the math and keep the data off-chain. The blockchain is simply responsible for collecting the results.

This hierarchy improves business performance and enables blockchain marketing to “pay in seconds” and “get in seconds”. However, if existing online services support the benefits of chain failure, it is likely that "downtime" caused by dYdX will occur. sim.

A bigger problem is that all companies that can provide cloud computing are controlled and centralized.

That said, the most decentralized app today is developed at the top of the program base, which, ironically, is true. When the service intermediates "downtime", whether they are running or on a regular basis, the split applications are also "downtime" at the same time. Ultimately, this slowdown may be "dominated" by regulators.

The facts have shown that these concerns are justified. In October 2020, dYdX announced the status of deposits and withdrawals, activities and operations, with slower performance than usual due to an increase in platform performance. It may not happen. , the user interface may lag behind.

Unfortunately, there is still no solution to the problem of the "crisis". People run an “emergency” risk when they prefer lower fuel prices and better performance.

03 The concept of CEX and the misunderstanding of DEX

For a long time, the two terms CEX and DEX were frequently compared. The main name of CEX, and the misconduct of many foundations, is often used to “cleanse the body” to prove the “insecurity” of root platforms.

In contrast, DEX deliberately avoids unstable “assumptions” that are no longer valid and only follow the “limitations” of the system and smart contracts.

In some process, all CEXs adopt the order book to determine the fair value of assets. The open order custodian is called the manufacturer and is responsible for delivering the product from one purchase to the next when the business is profitable and selling it when the business is successful, usually a specialized organization.

DEX also uses a book order, but generally does not use this type of market order, in general DEX's non-market-maker order book generally considers two disadvantages:

DEX order books follow the "highest value (i.e. order), first served" sorting rule, but the strength of the blockchain is in the hands of miners and miners can classify them. The order always in your best interest is first (eg risk of leakage).

In order to differentiate CEX from corporate defaults, expertise is responsible for the development of the industry, which can easily lead to a major impact on the network, DEXs should be developed by entrepreneurs, but they lacked capital and of expertise. So, most DEXs can only sacrifice one level of crack to depth.

By reducing time-consuming block generation, the risk of original sense preemption can be avoided to some extent, but it can make forking easier unless you are monopolized by the root of the problem, but faced with the following issues: second problem is the problem of the problem of centralization.

Therefore, if the DEX gets an order in the manual process, it should sacrifice the degree of decentralization to the depth, and finally, the CEX packaging industry, which is very important to the platform, can compete the CEX.

Also taking dYdX as an example, users only need to send the credentials to the Ethereum mainnet when funds are deposited and withdrawn, and there is no need to send the credentials to the Ethereum mainnet. the chain when there is an exchange.

This means that all data on the platform is falsifiable and centralized, making it difficult to balance slippage and permanent. In contrast, CEX, which has been criticized for its foundations, is playing a better role in this regard.

Misunderstandings between the terms of CEX and DEX have created a general understanding of the market, while also creating the misconception that decentralized applications are completely secure.

04 Content

From the above discussions, we can see a very clear picture. The security of the classification application affects not only its proper functioning, but also whether the models are formed by the same distribution.

Indeed, when examining the characteristics of blockchain, decentralization is the main theme of blockchain, and even when examining blockchain applications, the characteristic of centralization has been used as an advantage of evil.

Yes, distribution is not the main cost of blockchain, but at least the distribution model can be monitored and developed to be efficient. The decentralized situation makes the cost of fraud very high, so the blockchain can be seen as a cheap and reliable communication environment that does not require any third party, the future has to be decided by decentralized use. .

Although blockchain browsers were born into a wide range of decentralized applications, most blockchain browsers are still basic, keeping process blocks in place and then making them accessible to everyone used in online services.

The operation did not allow the noise of decentralization at rest to ensure the ease provided by the application in this environment. It is the “schizophrenia” of the whole industry.

Therefore, in predicting the development trajectory of future decentralized applications, it is inevitable to introduce fully decentralized changes, transforming the decentralized structure of infrastructure and migrating large amounts of information.

Centralized and weakly centralized applications will be rejected by users, and in fact, these applications cannot survive under current international regulations.

In a blockchain environment, the most realistic idea is to use the current state of blockchain to create a more equitable environment for users and platforms to monitor each other. Decentralization is one way and there is no other.

Scan QR code with WeChat